| |  | | | | | |

Bonds continue making investors money, but that's pushing yields lower. Where should an investor needing cash-flow look?

Over the weekend, the number of reported cases of coronavirus leapt.

It's now in 28 countries and governments around the world are scrambling to contain it. For example, Italy has canceled all public events in Venice and Milan. And South Korea has raised its disease alert to its highest level.

As I write Monday morning, markets are reeling. The Dow is down nearly 900 points, with investors flooding into the safe-haven assets of gold and bonds.

The rotation into bonds is driving prices up, which simultaneously lowers yields. In fact, the yield on the 30-year Treasury has now dropped to an all-time low. As I write, it's trading at 1.828%. For some perspective, the 30-year was at 2.44% as recently as this past November.

Meanwhile, last week, the yield on the 10-year Treasury inverted with the 3-month T-bill, stoking fresh recession talk. And as I write, the 10-year yield has fallen to its lowest level since July 2016.

How should we interpret this?

It turns out, master income investor, Neil George commented on the environment in bonds in his update to Profitable Investing subscribers last week.

From Neil: Now, as a bond guy from way back, an inverted curve is traditionally when the 10-year yield is lower than the two-year yield. That's not what we have. Yes, the sub-one-year yields are higher, with the three-month running at 1.57% compared to the 10-year at 1.55%.

But there are reasons behind this. The Federal Reserve and its Open Market Committee (FOMC) are working to keep the short-term rates higher than needed, with the target range for Fed Funds at 1.50%-1.75%. Meanwhile, its bond buying is rapidly ramping up its portfolio assets that are now topping $4.18 trillion.

Federal Reserve Assets -- Source: Federal Reserve & Bloomberg Finance, L.P.

The combination is very much a part of the short-end yields, with intermediate maturities dropping in yield and rising in price.

The other big forces are low inflation and rising demand by U.S. and global bond buyers, which I expect to continue.

Bond buyers are buying because the U.S. market is the best to own, which is why I've been recommending that you do so for the past two years. The COVID-19 mess will only help the bond market.

***Which bonds in particular does Neil like in this environment?

For that answer, let's turn to Neil's most recent issue of Profitable Investing.

Fortunately for Digest readers, Neil has allowed me to reveal one of his favorite bond funds today -- the BlackRock Credit Allocation Income Trust (BTZ).

From Neil's most recent issue:

The U.S. bond market is continuing where it left off in 2019 with further growth and income. The overall US Aggregate Bond Market Index by Bloomberg and Barclays has generated a total return for the trailing 12 months of 9.5%.

One of my favorite taxable bond investments remains the closed-end BlackRock Credit Allocation Income Trust (BTZ) ...

Yielding 7%, BTZ remains quite attractive. To that end, it still trades at a discount to its net asset value (NAV) by nearly 5%. The discount continues to narrow, however, aided by efforts of BlackRock to buy back up to 10% of the outstanding shares at a price of 98% of the NAV. Neil likes BTZ up to $14.85. As I write, it's trading at $14.58, so you still have room to initiate a new position.

***How will coronavirus affect the Fed and its interest rate policy?

Income investors are watching the Fed closely for clues about interest rate decisions in 2020. High on the list of variables that could influence rates is the coronavirus.

Minutes released last week from the Fed's Jan. 28-29 meeting revealed committee members held rates steady in part because the outlook for the economy had gotten "stronger" since the previous forecast in December. Furthermore, the minutes noted that "current stance of monetary policy was appropriate." (This means a range between 1.5% and 1.75%.)

However, these minutes reflected discussions that took place prior to the latest spread of the coronavirus outbreak -- and we may not have realized its full impact yet.

In fact, just two weeks after the January policy meeting, Federal Reserve Chairman Jerome Powell created space to revisit policy as he sat before the Senate Banking Committee. Specifically, he warned of risks to global supply chains from production shutdowns in China.

Powell noted, "We'll begin to see it in economic data coming up fairly soon. It's too uncertain to even speculate about what the level of that will be."

But perhaps the clearer message about how the coronavirus might impact Fed policy came from the Philadelphia Fed President, Patrick Harker: If the situation gets significantly worse, and we start to see significant impact on the U.S. economy, then we'd have to think about accommodation. But I don't think we're at that point right now. We just need to let this play out. Bottom line is we can't say that coronavirus will, in fact, lead to another rate cut in 2020 -- but we can say it kills any serious talk of a rate hike.

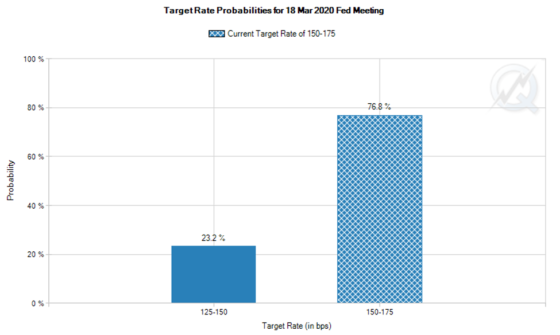

Below is the CME Group's FedWatch Tool. It places the odds of steady rates at the Fed's March 18 meeting at about 78%, with a 23% chance of a cut to the 1.25% - 1.50% range.

By the way, I looked at these numbers on Friday before the latest news on the coronavirus. The odds of a cut in March then were only at 10%. In other words, expectations for a cut have literally doubled over the weekend.

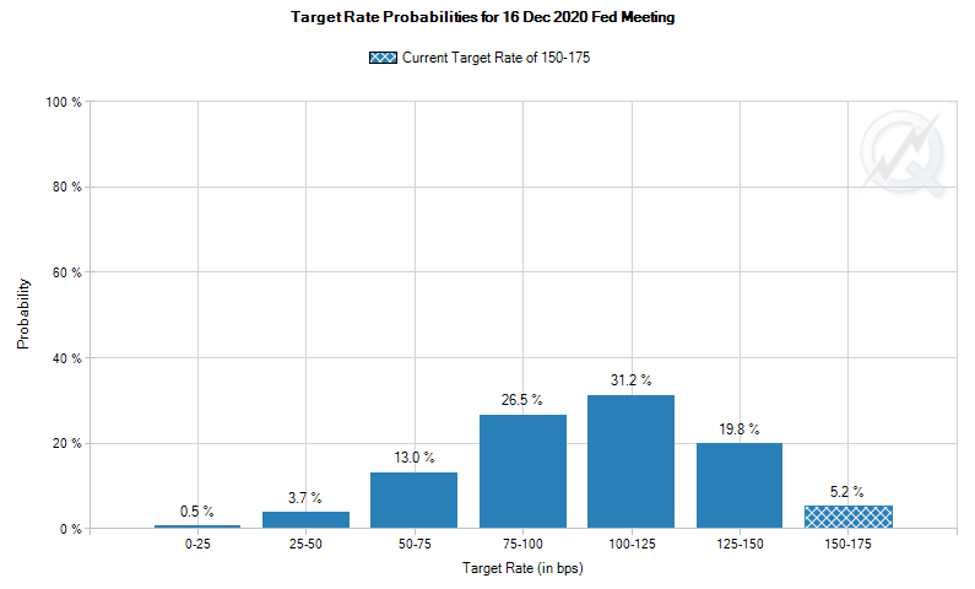

If we push out to the end of 2020, specifically, the Fed's December 16 meeting, we don't see any suggestion of a rate hike -- only potential cuts, as you can see below.

***Given this, the bottom line is that it remains a challenging environment for income investors needing cash-flow

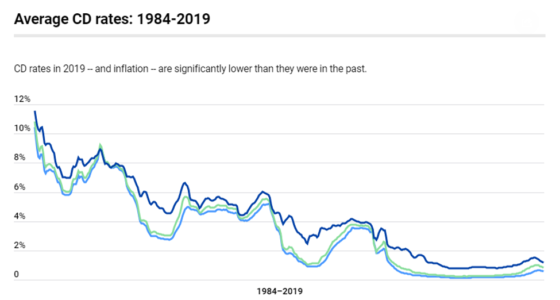

Below is a chart showing average CD rates from 1984 through last year.

Though the X-axis isn't labeled, all you have to do is look at the declining slope of the line to see the pain that income-investors have felt for years.

In short, whereas the average 1-year CD paid over 10% in 1984, Bankrate reports that as of the end of last month, the average 1-year CD pays just 0.76%.

Source: BankRate

But if you're looking for safe, high-yielding investments, there's hope ...

Last fall, Neil released a book that tackles this issue head-on. It's called Income for Life: 65 Income Streams ANYONE Can Collect.

The book includes 65 different income plays. There are investment ideas, as well as unique "side hustle" opportunities.

Here's Neil on the investment opportunities in the book: There are many securities which I outline that offer yields that are multiples greater than that of the S&P 500 and the general US bond market -- all with minimal risk from proven companies' stocks, bonds, preferred shares ETFs, closed-end funds, and other funds.

All of these are buy-and-own -- with no need to trade anything or deal with options strategies. And yes, I have plenty of yields running from 7%, 8%, 9% and over 10% -- all vetted and proven in their capability to deliver income for any individual investor. But as just mentioned, the book also includes non-market-related income ideas. Back to Neil: And it also provides numerous means to generate additional income outside the markets. There are countless ways to generate income beyond regular paychecks. And I present a wide variety of ideas and the steps needed to make them pay and pay well -- all while doing many things that folks are interested in already. To learn more about Income for Life: 65 Income Streams ANYONE Can Collect, click here.

Meanwhile, if Neil is right, expect more strength from bonds until we've gotten a handle on the coronavirus.

We'll continue to keep you up to speed. Have a good evening,

Jeff Remsburg

P.S. If you're looking for great sources of real income ...

Without having to get a second job ...

Neil George's new book, Income for Life, may be the most important financial book you'll ever read.

This massive book profiles more than 65 unique streams of income, capable of generating anywhere from $237 to over $10,312 every single month!

These are PROVEN cash-gushing strategies ... the kind typically used by the wealthy elite.

And the best part: Neil wants to send you a hardback version today, absolutely FREE.

But don't delay. Free copies of Income for Life are limited -- and going fast ...

Click here to claim yours now.

|

MANAGE YOUR INVESTORPLACE ACCOUNT: We hope this timely investing advice is valuable to you. As you know the markets move fast and conditions change frequently. So please check the current issue for the most recent advice. To make sure you received the most recent updates, please tell us if your email has changed by emailing us at feedback@investorplace.com. Go here to unsubscribe. InvestorPlace Media, LLC.

9201 Corporate Blvd, Suite 200

Rockville, MD 20850 If you have any questions call 1-800-219-8592. Copyright © 2020 InvestorPlace Media, LLC. All rights reserved.

Please note that we cannot be liable for any missed bulletins caused by overzealous filters. To ensure that you continue to receive this valuable part of your service please take a moment to add (Investors_Insights@investorplace.com) to your address book. Go here for instructions:

http://www.investorplace.com/whitelist.html?eml=Investors_Insights@investorplace.com | |

Popular posts from this blog

As your guide, I will explain effective canvas fabric treatments . Achieving reliable waterproofing depends on choosing the correct agent—like wax, silicone, or acrylics—matched to your specific canvas material and its function. This protection is fundamental for extending the life of canvas items exposed to weather, including applications like outdoor gear , protective covers (like boat covers ), apparel, and awnings . The process requires meticulous application onto clean, dry fabric. Sufficient time for the treatment to cure fully is necessary for bonding. Maintaining the treated canvas involves regular cleaning and periodic reapplication. I will detail the required steps: selecting the appropriate canvas type , identifying the best waterproofing methods, executing the application steps correctly, and understanding long-term fabric care . Key Takeaways: Identify your canvas type (cotton, synthetic, blend) to choose the best-suited treatment . Select a t...

Plus, Luke Lango's roadmap for investing under Trump November 7, 2024 The Fed cuts interest rates by 25 basis points … Powell sounds dovish … will Trump control Congress? … Luke Lango’s 10-point guideline for Trump 2.0 This afternoon, the Federal Reserve cut interest rates by 25 basis points, bringing the Fed Funds target rate down to 4.50% - 4.75%. While this was widely expected, the real story was Federal Reserve Chairman Jerome Powell and his press conference… It was about as dovish as anything that bulls could want. Powell sounded confident about the condition of both the labor market and inflation… he downplayed the recent run-up in Treasury yields… and he openly praised the strength of the economy. I watched the market’s reaction to his live press conference in real time, noting a s...

When will dominance switch from Bitcoin to altcoins? December 3, 2024 Bitcoin price predictions … why Luke Lango is looking beyond Bitcoin … perspective for crypto naysayers … where to start investing today Let’s begin today with our crypto expert Luke Lango and his forecast for Bitcoin: We think Bitcoin can rally to $120,000 by Christmas. We think this Fourth Boom Cycle has about 12 months runway left, with room for Bitcoin to pop towards $200,000 by late 2025. And we also believe altcoins will start to join the party soon and could soar in 2025, similar to how they soared in 2021. Let’s back up and fill in a few details. Since Trump’s victory on November 6, Bitcoin has exploded 42% and forecasts predict that bigger returns are coming Beneath Bitcoin’s price surge has been record-settin...

|

Comments

Post a Comment