| Powell statement boosts markets, but has the Fed changed its interest rate target? ... Consumer spending keeps U.S. economy healthy ---------------------------------- Don't Bet on Fed Easing Yet When the Fed Chairman speaks, the market hangs, quite literally, on every single word.

That's why every Chairman is so careful about what he or she says.

On Wednesday, Fed Chairman Jerome Powell spoke in NYC, and said, "Interest rates are still low by historical standards, and they remain just below the broad range of estimates of the level that would be neutral for the economy -- that is, neither speeding up nor slowing down growth."

This was a big change from when he spoke in October and said interest rates were "a long way from neutral."

After his statement, the Dow spiked more than 600 points -- the Dow's largest one-day gain since March. And the S&P 500, Dow and Nasdaq all closed the day more than 2% higher.

Does this mean the Fed is reconsidering raising interest rates?

I asked Louis Navellier, editor of Growth Investor, to help put Powell's remarks into context for investors. Translated from Fedspeak: There are a lot of reasons why the Fed should stop raising key interest rates.

Clearly, the Fed has several excuses to stop raising key interest rates. But the Fed is also notorious for raising key interest rates in December when Main Street and Wall Street are distracted by the holidays. So, many economists are still forecasting a fourth key interest rate hike for this year. OK, Louis, are we convinced from this statement that the Fed won't raise interest rates in 2019? Personally, I don't think that Powell's comments were dovish enough. Yes, they sparked a stunning market rally.

But the December FOMC statement will be much more important.

We need an incredible dovish statement where the Fed acknowledges that economic growth has slowed, inflation has moderated and the Treasury yields have stopped rising. If that happens in December, it won't matter if the Fed raises rates or not. The stock market will surge higher. Until we get that kind of signal, prospects the Fed will ease off are overblown, according to Louis. So Louis, what do you recommend that investors do with their money given this uncertainty?

I'm advising subscribers to my premium newsletters to focus their investments on dividend growth stocks and stocks with superior fundamentals. Given the current flight to quality and drop in Treasury yields, these stocks will be ripe for the picking in the coming weeks. Louis is also recommending specific dividend stocks, too. To learn more about the specific dividend stocks he is recommending for immediate purchase, check out Louis' critical presentation here.

U.S. Economy Still Strong Consumer spending drives the economy.

That's just a fact.

As I mentioned yesterday, Black Friday to Cyber Monday sales broke all sorts of records, including the most sales ever made from mobile devices.

And that's just a continuation of a long-term trend that wise investors need to be aware of. Consumer purchasing is an increasingly large driver of our overall economic health.

As Louis mentioned above, the Fed published PCE numbers, a fancy way to show how much consumers are spending. Just as Louis was putting these numbers into context, John Jagerson and Wade Hansen were highlighting the same stats for their Strategic Trader readers.

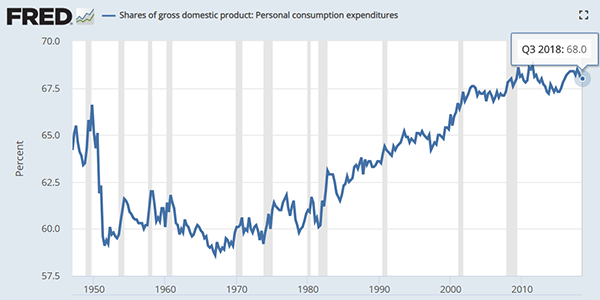

Personal Consumption Expenditures (PCE) currently accounts for 68.3% of the Gross Domestic Product (GDP) in the United States (see Fig. 1).  Fig. 1 - Percent of GDP Driven by PCE (source St. Louis Fed FRED Charts) It hasn't always been this way. In 1967, consumer spending only accounted for 58.6% of GDP.

As the decades have gone by, however, the U.S. consumer has become increasingly important.

That's why traders pay such close attention to consumer confidence numbers. The more confident consumers are, the more they tend to spend. The less confident consumers are, the less they tend to spend.

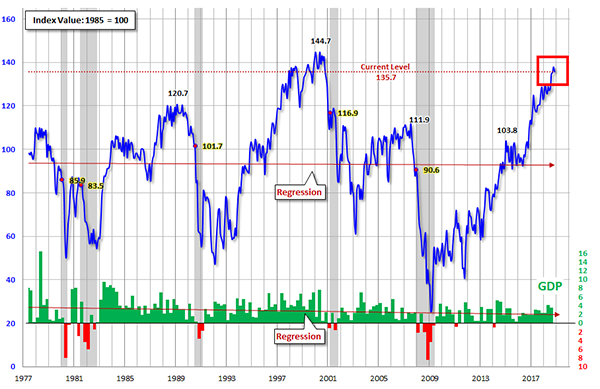

As you can see in Fig. 2, the Conference Board Consumer Confidence numbers have been steadily climbing since the Financial Crisis of 2008 and are now near all-time highs.  Fig. 2 - Conference Board Consumer Confidence (source Advisor Perspectives) This trend has been great for the U.S. economy, but consumer confidence pulled back a bit last month ...

It's too early to tell if this is just a temporary pullback or the end of the longer-term uptrend, but traders are watching closely. Looking at these data points, investors are understandably frustrated that things in the markets aren't going better.

Last Saturday I shared data on the high number of Q3 earnings reports that exceeded expectations.

As Louis noted above, the Commerce Department reported this week that third-quarter GDP was a stunning 3.5%.

And now we know that consumer confidence is still very high.

The economy continues to hum along.

There are some concerning signals, but investors should be confident in the underlying health of the U.S. economy.

All eyes this weekend are now on Buenos Aires and whether President Trump can ease trading tensions with China, and if Russia and Saudi Arabia can come to new agreements about oil production.

Positive signs on either front would be welcome for the markets.

To a richer life,

Luis Hernandez, Managing Editor

and the research team at InvestorPlace.com P.S. December 4th is nearly here Digest readers know that I think the opportunity created by the legalization of marijuana is creating one of the great investing opportunities of our lifetime.

My colleague Matt McCall has told me for months to mark my calendar for Tuesday, Dec. 4th. I don't know what you have planned for this day right now ... But whatever you're doing, I suggest you rearrange your schedule, because you've got the chance to make a heck of a lot of money, beginning on this exact day.

All thanks to the red-hot cannabis industry ...

Even if you don't know a thing about the marijuana markets ...

Even if you've never bought a stock before ...

If you have a just small amount of cash, you could multiply your money many times over beginning just a few weeks from today. What's going on exactly and how can you cash in?

Click here for his exclusive presentation that tells you the full story.

|

Comments

Post a Comment