| FAANGs Plunge but That Doesn't Mean Sell 'em All Tech stocks have been hit particularly hard during the recent market sell-off and the much touted FAANG stocks are leading the hurt.

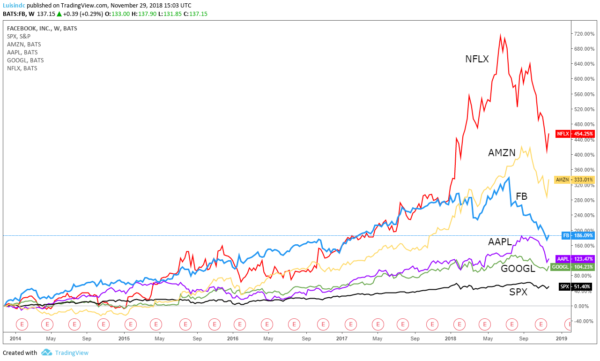

Over the last five years, Facebook, Apple, Amazon, Netflix and Google (Alphabet) have outperformed the broader S&P by a wide margin, as illustrated in the chart below.

Lots of money has been made on these five stocks. Hopefully you've participated in the run-up along the way.

And if you think you don't own these stocks, the truth is you do if you own any mutual fund. Looking at the assets of virtually every big mutual fund you'll find exposure to at least some of the FAANG stocks. In fact, the five FAANG stocks make up about 13% of the total value of the S&P.

What all that means is that when they lag they take the rest of the market with them.

It also means until FAANG stocks recover, the market is going to look weak.

So, what are the prospects for this group of market out-performers? I posed this question to InvestorPlace's best analysts. I think you'll find their insights meaningful.

Facebook (FB) was already plunging after a July earnings report when they announced that future earnings would not meet previous expectations. Their decline was compounded this month when The New York Times published a report that claims CEO Mark Zuckerberg and COO Sheryl Sandberg ignored warnings about several issues, including Cambridge Analytica harvesting information on 87 million users and election meddling during the 2016 election. Once the issues surfaced, the report claims the two shifted blame and hired a PR firm to defame it critics.

Since the fateful July 25 earnings call, the stock is down more than 36%. Matt McCall, editor of Investment Opportunities believes no one should give up on the social media giant.

One thing that hasn't changed is Facebook's position as the clear leader in social media, especially with its ownership of Instagram. It is heading in the right direction, and even with a temporary slowdown, future growth should be robust for a long time to come. That makes the stock a buy at current prices for those of us taking the longer-term approach.

Please note that I'm not saying the selling in FB is done ... it may drift lower still, but I don't see a lot of additional downside risk, and there's little doubt the upside from here remains significant. FB stock remains a buy according to Matt.

Amazon (AMZN) had fallen more 25% since making an all-time closing high of $2,039.51 on Sept. 4.

Louis Navellier, editor of Accelerated Profits is still very bullish on AMZN and views the recent dip as a buying opportunity. In the near-term, online shopping from Thanksgiving through Cyber Monday set records this year, and Amazon.com accounts for 50% of all holiday shopping. But Louis is in the stock for the long-term.

I understand that AMZN comes with a hefty price tag, so if you'd rather not add the stock at this time, that's fine. However, when it comes to monopolistic, market-dominating companies like Amazon, I am comfortable with paying a premium. Judging from analysts' forecasts, Amazon shows no signs of slowing down.

For FY 2019, analysts are forecasting 34.8% annual earnings growth and 20.4% annual sales growth. Then again, Amazon has a history of blowout earnings surprises. In fact, for the past several quarters, Amazon has posted double-, triple- and even quadruple-digit earnings surprises! The good news is that AMZN remains a buy, according to Louis. And the price is a bargain after coming off of its peak.

The company facing the biggest headwinds is Apple (AAPL). Their downturn started when they announced at their last earnings call that they would no longer report iPhone sales as they did not believe the number presented a true representation of the state of their business. The market quickly voted against that decision. Since Oct. 1, AAPL stock is down more than 20%.

Neil George, editor of Profitable Investing, explains why so many are down on the stock, and the headwinds it will be forced to overcome to get back on the positive side. First, we continue to have reports of supplier and assembly cutbacks, which point to lower unit sales of the company's core iPhone products. Fewer units means fewer potential buyers of applications and other services, which Apple needs to generate more recurring income.

Apple has lost market share in China as well as the rest of Asia, while Europe is just flat and North America is down from the previous quarter.

Japan, which accounts for 8% of iPhone sales, is now slowing its demand for newer iPhones as it follows other markets into lower adoption of the next phone models. The primary telecom companies in Japan are demanding higher subsidies from Apple to offer its iPhones on their networks and in their stores. This means tighter margins for the company and shows that its unit growth is in more trouble.

Then we come to the big problem that the company is facing with the Supreme Court of the United States. The company is being sued in the case of Apple Inc. v Pepper, in which Apple customers are alleging anti-trust violations in application (app) sales.

The customers are saying that since Apple apps can only be bought through the company and not from other vendors -- as opposed to the model used for Android devices from Alphabet's Google (GOOGL) -- Apple effectively controls the price and fees for listing apps on the Apple platform.

If SCOTUS rules against Apple, it will open up a myriad of class-action lawsuits that would cost Apple in refunded payments and might force the company to open up its platform for apps to third-party companies. This could result in a massive hit to its services revenue, which are already under threat from slower unit sales.

It will take some time for the verdict and then the subsequent class-action suits to be filed. But it is an ominous cloud on the horizon for Apple. Neil is calling this stock a hold until there are more positive signs. Be cautious with AAPL stock. Netflix (NFLX) is down more than 25% since Oct. 1. For the year, however, NFLX stock is up more than 35%.

So, what's changed in the Netflix business since October? Not much.

As Contributor Vince Martin reported on InvestorPlace.com recently, the company reported strong third-quarter results. Its earnings and subscriber growth both came in well ahead of its guidance and Street expectations. And the results seemed to mitigate many of the concerns raised by its more disappointing Q2 report back in July.

Vince remains bullish on Netflix stock:

And so for investors who see the market selloff as an opportunity, Netflix stock should look very attractive right here. It's possible, obviously, that NFLX stock was simply too expensive in June and July, when the stock traded above $400. Still, investors who believe market sentiment will improve should look closely at Netflix stock, which has a clear, near-term path back to $300+ and beyond. Of course, they are looking at stiffer competition as Disney and Warner Brothers get closer to launching streaming entertainment services, but we knew that during the summer, too. And frankly until either company can prove an ability to aggregate audience to such a service, the risk there remains minimal.

Vince says that NFLX remains a buy. Alphabet (GOOG) is down more than 12% since Oct. 1, as its ad revenue growth has slowed, in addition to facing more competition for ad dollars from Amazon. They are also facing headwinds in their cloud business from MSFT gaining market share.

But this is another case where the market conditions don't justify the stock price plunge according to InvestorPlace.com contributor Nicholas Chahine.

GOOG is caught up in this silly acronym and it gets punished along with Facebook headlines that are specific only to FB. GOOG stock also suffers when Netflix's valuation comes into question.

So this is a clear case of a sentiment crisis in the Google stock price and not its business prospects. Unfortunately, in early October, GOOG needed to hold the $1130 zone but it didn't. Its failure brought in momentum sellers for another 10% dip. And when you look at its year-to-date gains, it is still in the red.

Luckily, this strengthens the fundamental argument for Google stock. GOOG's forward price-to-earnings ratio is now 24 ...

Those who have held on to GOOG stock this long would be making a mistake in selling it now. All the reasons for owning it a few months ago still exist, as nothing in the macro economy changed to materially affect its fundamentals.

Despite the headline fears, investors who buy for the long term will recognize the value that is building in Google stock as its price falls. They all have an entry level in mind and all they need are a few days without new headline risk. So, despite the selloffs, analysts are all still optimistic about all the FAANG stocks for one reason or another. Investors holding these stocks would be wise to keep them, or look for new entry points.

Until they turn around, however, they are going to continue to drag down the broader market.

To a richer life ...

Luis Hernandez, Managing Editor

and the research team at InvestorPlace.com

P.S. December 4th is nearly here Digest readers know that I think the opportunity created by the legalization of marijuana is creating one of the great investing opportunities of our lifetime.

My colleague Matt McCall has told me for months to mark my calendar for Tuesday, Dec. 4th. I don't know what you have planned for this day right now ... But whatever you're doing, I suggest you rearrange your schedule, because you've got the chance to make a heck of a lot of money, beginning on this exact day.

All thanks to the red-hot cannabis industry ...

Even if you don't know a thing about the marijuana markets ...

Even if you've never bought a stock before ...

If you have a just small amount of cash, you could multiply your money many times over beginning just a few weeks from today. What's going on exactly and how can you cash in?

Click here for his exclusive presentation that tells you the full story.

|

Comments

Post a Comment