| A Warning Sign for Your Portfolio I've written before about the inverted yield curve and what it might mean for the markets.

The yield curve is the difference between long-term U.S. Treasury bonds interest rates and short-term U.S. Treasury bond interest rates.

Normally, long-term rates are higher because investors expect a higher return in exchange for putting their money away for longer -- and this creates a "curve" between the two interest rate numbers.

As the markets sank yesterday, the yield for the three-year note rose above the yield for the five-year note by 1.4 basis points.

To put that into context for you, that's 0.014%. Not a lot.

Meanwhile, the gap between the two-year and 10-year notes continued to flatten. In fact, the market has been much more concerned with this yield curve than the gap between the three-year and five-year notes, which are typically much closer.

Many analysts see these signs as an indicator that the market is slowing and that conditions are right for a broader economic recession.

Listening to the talking heads on TV, you'd think a recession was imminent. But the truth is, as usual, more complicated.

The uncertainty in this current market climate, especially associated with a possible trade war with China, means every indicator gets a lot of attention.

I love the insight that Jeff DeMaso and Dan Wiener, editors of the Independent Adviser for Vanguard Investors provide their readers on macro issues. And their take on this development for their subscribers didn't disappoint.

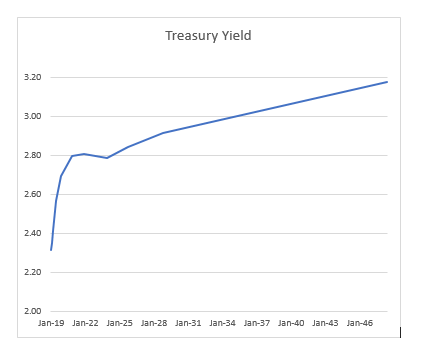

Jeff and Dan specialize in telling their readers what fund companies won't. They specialize in performing the analysis and explaining the market conditions that get their readers better returns, and I'm happy to share their analysis with Digest readers. Here's what today's curve looks like:  According to a new paper (https://doi.org/10.20955/es.2018.30) from the Federal Reserve Bank of St. Louis research staff, inverted yield curves do not forecast recessions, but simply forecast conditions in which a recession becomes more likely.

Those conditions are typically a slowing in economic growth, not a reversal. And after three quarters in which corporate earnings have grown at 20% and GDP has expanded at between 2.2% and 4.2% powered in part by a corporate tax cut, it's by no means a stretch to think that growth will slow.

So, the difference between forecasting a recession and forecasting a slowing is important because it means that it would take a sustained period of slowing before one could say a recession is imminent. Luis here again. The distinction Jeff and Dan highlight is important, but their analysis of what happens when the yield curve flattens is what really caught my attention.

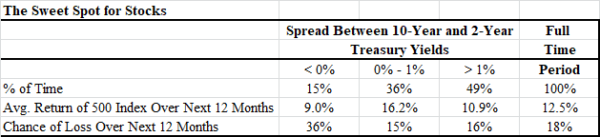

It can actually signal stronger market returns ahead! We took a look at the 2-year-to-10-year Treasury spread for every month since Vanguard introduced its S&P-tracking 500 Index in 1986.

We divided those months into three buckets: Spreads less than 0% (an inverted yield curve); spreads of 0% to 1%; and spreads greater than 1%.

Then we calculated the fund's (market's) returns over the ensuing 12 months for each of the buckets.

When the 2-year to 10-year Treasury spread has been between 0% and 1%, as it is today, 500 Index experienced its strongest returns on average over the following year. Additionally, during these times, stock losses happened with less frequency.

This week's inversion of a small section of the yield curve may be bullish for those with bearish inclinations, but the reality is that the U.S. economy remains quite a ways away from a recession.

Wall Street's daily perturbation notwithstanding, we think that continued earnings growth, still-low interest rates and a fully-employed consumer with the means and desire to spend sends a bullish, rather than bearish signal

If you need more convincing, consider the view of legendary growth investor Louis Navellier. Here's his opinion about any pundit saying an inverted yield curve is a sign of a recession: Totally bogus. Louis, editor of Growth Investor, has a long track record of making money regardless of the market conditions and he attributed Tuesday's plunge to several factors having nothing to do with the yield curve.

Louis notes that professional traders wanting to clean out their inventories before the market holiday associated with the funeral for former president George H.W. Bush and chaos in European markets associated with Brexit and French energy protests caused a temporary flight to the dollar.

But he noted some good news for investors in all this market volatility and falling treasury yields: Because of falling treasury yields, our Fed is going to have to stop raising rates sooner rather than later. We are going to have a dovish FOMC statement in several days, and we can see light at the end of the tunnel. We could all use some good market news, so everyone should be looking to that FOMC statement as the next big sign for the market.

In fact, Louis believes this year's tax reform law is about to cause an avalanche of money to rush into the markets in the coming months. In his Growth Investor newsletter, he's recommending that his readers buy specific dividend stocks that are positioned to take advantage. To learn more about the dividend stocks he is recommending for immediate purchase, check out Louis' critical presentation here.

To a richer life ...

Luis Hernandez, Managing Editor

and the research team at InvestorPlace.com

P.S. The Next Big Day for Marijuana Stocks

Digest readers know that I think the opportunity created by the legalization of marijuana is creating one of the great investing opportunities of our lifetime.

My colleague Matt McCall has told me to mark my calendar for Tuesday, Jan. 23rd. That day marks another opportunity to cash in on the marijuana megatrend.

Whatever you're doing, I suggest you rearrange your schedule, because you've got the chance to make a heck of a lot of money, beginning on this exact day.

All thanks to the red-hot cannabis industry ...

Even if you don't know a thing about the marijuana markets ...

Even if you've never bought a stock before ...

If you have a just small amount of cash, you could multiply your money many times over beginning just a few weeks from today. What's going on exactly and how can you cash in?

Click here for his exclusive presentation that tells you the full story.

|

Comments

Post a Comment