After years of disappointing returns, MLPs appear to be carving out a bottom, potentially setting up for gains and big income distributions

Which would you prefer -- investing in a wildly-popular market sector that's flying high? The financial media and all your neighbors are singing its praises and boasting about huge gains?

Or a sector that's been beaten down, dragged through the streets, and left for dead?

For us, this question is a no-brainer. Option 2.

The reason is because when a sector is flying high, market sentiment is wildly bullish, and everyone is invested in it, who's left to continue buying it in order to push prices higher? On the flip side, when a sector has been utterly destroyed, and conditions have already reached that puke point, "up" is generally the only direction left.

Today, let's look at one such beaten-down sector and consider a trade that not only could see significant growth, but will pay you a fat income distribution while you wait

I'm talking about the MLP sector, which stands for Master Limited Partnership. To be fair, MLPs are less of a "sector" and more of a tax-advantaged form of financing that wraps around some underlying businesses. In this case, that underlying business is energy transportation -- specifically, the pipelines that transport crude oil from the producers all the way down to the distributors. These are some of the most valuable, strategically significant assets in the United States.

You've heard how the shale boom has resulted in the U.S. becoming the world's leading oil producer? Well, these are the pipelines that move all that oil from place to place. They're literally the veins of the sprawling U.S. energy complex.

Now, some quick context to make sure we're all on the same page ...

Traditionally, MLPs have been an income investment, offering investors huge yields -- often in the ranges of the 7%-9%. You see, MLPs have a different tax-treatment -- they pay no corporate tax, but in return, they must pay out a large percentage of their income to unit holders.

So, historically, yield-hungry investors have turned to MLPs for income. However, today, we're looking at the potential for both income and significant price appreciation.

The MLP destruction of several years ago is giving us a new opportunity today

"Midstream" MLPs refer to the MLPs that process, transport, and store oil (there are also "upstream" and "downstream" MLPs). This distinction is important because midstream MLPs are less tied to the actual price of oil. This is because most midstream firms just transport the commodity, so they get paid based on the volume of oil transported, not based on oil's price. You might think of it like a toll road, with the rates locked in by long-term contracts.

This gives MLPs some insulation from oil prices, but what happens when oil prices drop so low that oil companies can't pay the toll prices?

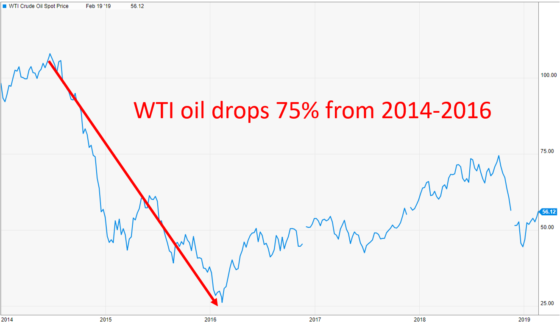

That's what happened from 2014 through 2016. The chart below shows the spot price of WTI crude, falling 75% between June 2014 and February 2016.

When WTI prices plunged, MLPs suffered major collateral damage. Some oil companies weren't able to honor their service contracts, so MLP revenues fell, which resulted in many MLPs being forced to cut their distributions. This caused many investors to abandon MLPs, which sent prices spiraling.

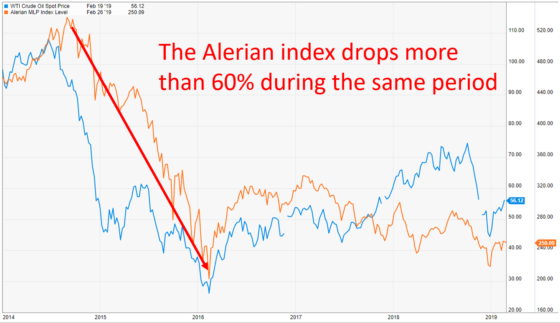

To illustrate, let's look at the Alerian MLP Index. It tracks some of the biggest midstream pipeline companies in the U.S., including Enterprise Products Partners, Plains All American, and Magellan.

Below we show the same chart as above (the price of WTI crude) but this time it includes the price of the Alerian MLP Index. You'll see it fell by more than 60% during this period.

As you can see, MLPs got destroyed, and haven't fully recovered. In fact, though they gained some ground through early 2017, they've fallen since and suffered a painful 2018, culminated by a fourth quarter plunge that mirrored the drop in oil prices.

But this pain now means very attractive valuations for those investors willing to accept the risk

While MLP prices have suffered over the last few years, some important things have happened behind the scenes.

Many MLP companies have spent this time cleaning up their balance sheets, improving operational efficiencies, and cultivating future growth prospects. This means the current valuations at which many MLPs are priced doesn't fairly reflect the balance sheet and operational improvements these companies have made since oil crashed.

The reality is that many MLPs are on firmer footing. They have less debt, better distribution, and even a lower cost of capital.

Meanwhile, many oil exploration companies have made technological improvements that enable them to be profitable at lower oil prices. The result? They still need the pipelines to transport their product. So, we have fundamentally-stronger MLPs servicing oil companies that can profitably operate at lower oil prices. That's a good combination.

Despite this, MLP valuations aren't far from their multi-year lows. The Alerian MLP ETF, AMLP, tracks the Alerian Index. As I write, it's trading at $9.80. At its lowest point in 2016, when WTI prices had plunged down into the $20s (from a high of over $100 months before), AMLP hit a bottom of $7.97. That's just 18% below today's valuation. Meanwhile, the price of WTI itself has rebounded nearly 50% from its 2016 lows. In other words, there's plenty of upward room for MLP valuations to climb relative to oil prices.

Meanwhile, as you wait for capital gains, you're collecting fat income checks

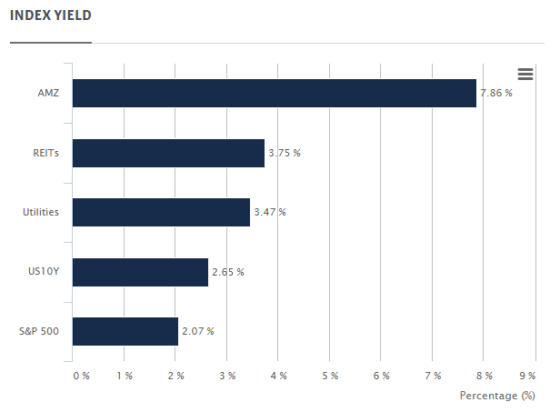

Let's not forget the "income" component of all this. As I write, the Alerian MLP index yields 7.86%. This crushes the average yields of competing income investment sectors. See for yourself ...

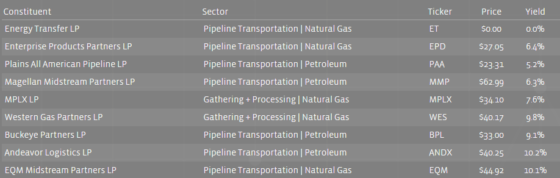

So, even if you're early and MLPs trade sideways as the sector continues to heal from 2015/2016, you're collecting significant income. Many individual MLPs are yielding even more ...

***Neil George, editor of Profitable Investing highlighted the strong income potential from MLPs in his latest March issue

Neil specializes in income investments. So, it's no surprise he's on top of opportunities in the MLP space.

From Neil's March issue:

Climbing further in the ranking is another one of my favored market segments -- the toll-takers of the petroleum market. Tracked by the Alerian MLP Infrastructure Index, the midstream energy sector is up 14.05%. Pipelines and related companies are flush with cash from oil and gas producers and, while there continues to be constraints in capacity, several of our holdings will be bringing on additional capacity, with expanded services coming on line this year and next.

This will bring even more cash to fund rising dividend distributions, which like the REITs, continue to be great tax-advantaged income buys. Neil holds a basket of big-name MLPs in his portfolio. If you'd like to learn more, click here.

***Although we expect some of the blue-chip MLPs to do very well, we suggest you consider shopping off the main avenue for bargains

Specifically, look at those MLPs with sub-$2 billion market caps.

Why? Huge hedge funds and massive pensions can't operate in this space. They're simply too big to take any meaningful-sized position in an MLP less than $2 billion. This means that competition for bargains isn't as fierce. Price anomalies are larger and appear more frequently in the smaller MLPs.

Our very own CEO, Brian Hunt, wrote an article on this idea of focusing on smaller-cap investments. It's a powerful investing principle which deserves a few minutes of your time in reading it. In essence, why try to invest in a sector that's crowded with huge competition, where all the bargains have been picked over, when you could hunt in a sector where few investors go, which still offers undiscovered gems and great values?

If you're interested in finding these smaller MLPs on your own, two suggestions: one, pay attention to the distribution coverage ratio. This is the cash generated by the MLP divided by the cash paid to shareholders. The higher this ratio, the better, since that means there's plenty of cash available for payments (and increasing payments).

Second, analyze the history of the MLP's distribution. Has it been consistent and climbing over time? Or have there been distribution-cuts or even gaps? Obviously, the more consistent the payments, the better.

Low valuations, high yields, and recovering fundamentals in the MLP space appear interesting. If the space isn't on your radar, perhaps it's time to take a look. We'll continue to monitor MLPs and keep you up to speed over the coming quarters.

Have a good evening,

Jeff Remsburg

P.S. Where should the savvy investor look for performance in this market?

Legendary investor Louis Navellier believes this year's tax reform law will cause an avalanche of money to rush into the markets in the coming months.

In his Growth Investor newsletter, he's recommending that his readers buy specific dividend stocks that are positioned to take advantage. To learn more about the dividend stocks he is recommending for immediate purchase, check out Louis' critical report here.

|

Comments

Post a Comment