Data suggests a healthy economy could underpin additional market gains as 2019 rolls on

As of last Friday, nearly half of the S&P companies have reported earnings. And despite many headlines from a few weeks ago calling for a market slump based on a brutal earnings recession, the S&P closed yesterday at 2,943, an all-time high.

With this as our backdrop, in today's Digest, let's pull back and look at the big picture. We'll recap earnings here at the mid-way point in the season, then we'll look at some macro indicators to see what they're telling us about the rest of the year.

Lots to cover, so let's jump in.

***Earnings season isn't the disaster many were anticipating

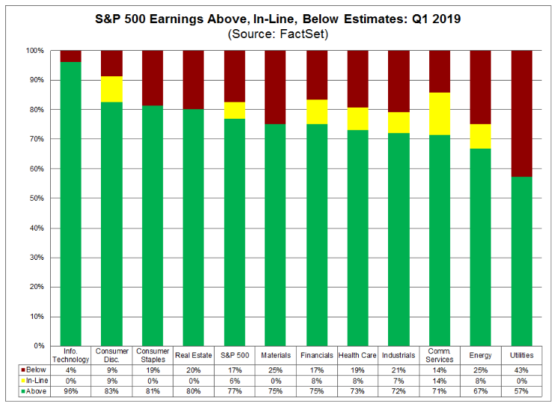

As of last Friday, nearly half (46%) of the companies in the S&P had reported Q1 earnings. Of that, 77% have beaten estimates. According to FactSet, companies are reporting earnings that are 5.4% above estimates, which is above 5-year averages.

Below is a chart breaking down how the various sector earnings have come in. Note the tech sector boasting a whopping 96% of companies beating estimates. On the low end, only 57% of utility companies have beaten to date.

What about revenues? After all, sometimes revenues paint a better picture of corporate health, since earnings per share numbers can be manipulated by fuzzy accounting and/or share buybacks. Some analysts argue that sales are a purer portrait of how a company is doing, since they focus exclusively on consumer demand.

Here, we find that 59% of companies that have reported to date have beaten sales estimates. That number is in-line with 5-year averages -- certainly not the train-wreck many were calling for a few weeks ago.

Looking forward to the second half of earnings season, the blended earnings number (which combines results so far with the estimates of the companies yet to report) comes in at -2.3%. That's smaller than the -3.9% earnings decline that was projected last week.

***While earnings are better than expected, they're still negative -- so why is the market hitting new highs?

We touched on this in our April 3rd Digest. From that issue:

So, where are we in regards to earnings expectations for Q1?

The phrase "in the toilet" comes to mind ...

... according to the financial media and respected research groups like FactSet, Q1 earnings are going to be rough.

But if that's the expectation -- which is now widely embraced and saturating the headlines -- how shocked can the market actually be if/when it happens? As that issue pointed out, while earnings quality drives stock prices in the long-term, in the short-term, what drives prices is surprises to earnings expectations. And so far in Q1, we've seen more positive surprises ... largely because expectations were so low. That's why we're seeing the market hitting new highs, despite declining year-over-year earnings numbers.

For the rest of the year, FactSet is calling for a slight decline in earnings in the second quarter, low single-digit earnings growth in the third quarter, and high single-digit earnings growth in the fourth quarter.

***Whether or not we hit these estimates will, in part, depend on our broader, economic environment. So, what clues are recent data giving us about our overall health?

Let's start with gross domestic product (GDP).

Last week, we learned that the U.S. economy grew at a much faster pace than expected. While economists were anticipating 2.5% growth, Q1 GDP actually clocked in at 3.2%. That's the strongest first quarter for the U.S. economy since 2015. And remember, these numbers reflect the economy during the longest government shutdown in history (35 days, between late December and late January).

While GDP numbers are often revised, this 2.5% growth at least suggests that we're not an any imminent danger of a recession.

So far, so good.

***Consumer spending, another key economic health indicator, is showing strength

Yesterday, we learned that U.S. consumers ramped up spending in February and March (we received two months of data due to the government shutdown from earlier in the year).

Personal-consumption expenditures (cars, computers, drinks ...) came in at 0.1% for February and 0.9% for March. Expectations were for 0.3% in February and 0.7% in March.

But let me contextualize this number a bit better. That 0.9% number in March is actually the best number in nearly 10 years. To be posting this rate of growth so late in a bull market makes this figure especially impressive.

Economists are interpreting the data as suggesting that the U.S. consumer remained cautious in February, nervous about the impact of the government shutdown. But by March, those lingering fears had subsided, and people were ready to spend again.

So, here too, we have positive news. When the U.S. consumer is opening their wallets, it bodes well for corporate revenues and earnings numbers for the rest of the year. After all, consumer spending accounts for more than two-thirds of U.S. economic activity.

***Finally, inflation data was unchanged, and remains well below Fed targets

Yesterday's report also contained new information about inflation.

The Federal Reserve's preferred inflation gauge is the core personal consumption expenditures index. It strips out food and energy prices, which are more volatile (of course, food and energy prices have a huge impact on your wallet and mine, so in another Digest we'll have to dig into some issues with this measure of inflation).

But for now, the number was flat for March. That meant that the yearly rate lowered from 1.7% down to 1.6%. This is the lowest inflation rate since September of 2017.

So, what does this number really mean?

Well, the Fed considers 2% its inflation target. It deems that to be a healthy level for price stability. Of course, we haven't seen 2% inflation for most of the past decade.

But many analysts believe this 1.6% figure leaves us in a sweet spot for the moment. In other words, inflation isn't high enough to cause the Fed to want to cool down the economy via a rate hike ... on the other hand, inflation isn't so low that that the Fed might be tempted to cut rates in an effort to bolster the economy.

Now, while that can change, it appears we're enjoying a "Goldilocks" moment for the time-being.

We'll learn more this week as Fed officials meet today and tomorrow to assess the economy and deliberate on any policy changes. Expectations are that the Fed will hold interest rates steady. Data from CME Group puts the odds that the Fed leaves rates alone at 97%.

***One final note on shorter-term market direction

While the data we just covered bodes well for the economy, and by extension, the investments markets, as 2019 rolls on, short-term market movement can be anyone's guess.

But on that note, I want to draw attention to one indicator.

Over the last few days, we featured market analysis from several of our experts. One indicator which showed up on the radars of two of our analysts was the performance of the Russell 2000.

First, John Jagerson and Wade Hansen from Strategic Trader noted that they wanted to see the Russell 2000 stay above a resistance break of 1590.

Then there was Ken Trester, editor of Power Options Weekly. He wanted to see index breakout to levels above 1600 before he got too bullish in the short-term.

Well, yesterday, the index pierced 1600 before pulling back slightly, closing the day at 1598. As I write Tuesday morning, the markets are selling off a bit, and the Russell 2000 is down to 1594. So, we're still teetering at key resistance levels.

We'll be watching over the new few sessions to see if we can break through 1600 and stay there. We'll continue to keep you updated here in the Digest.

Have a good evening,

Jeff Remsburg

P.S. Mark your calendar for Friday, May 31

I don't know what you have planned for this day right now ...

But whatever you're doing, I suggest you rearrange your schedule, because you've got the chance to make a heck of a lot of money, beginning on this exact day.

All thanks to the red-hot cannabis industry ...

Even if you don't know a thing about the marijuana markets ...

Even if you've never bought a stock before ...

If you have a just small amount of cash, you could multiply your money many times over beginning next week. What's going on exactly and how can you cash in?

Click here for Matt McCall's exclusive presentation that tells you the full story.

|

Comments

Post a Comment