Gold is making a move ... but for even bigger gains, here's where to look

NOTE: The stock market and our offices will be closed on Monday in observance of Labor Day. We'll pick back up with our normal publishing schedule on Tuesday after the Weekend Edition. Enjoy the holiday!

Over the years, gold has developed a reputation as a "safe haven" asset. In other words, when riskier markets (like stocks or fiat currencies) crash, people flock to gold to protect their wealth.

In this way, gold's main role in a portfolio is as a chaos hedge or wealth preserver. This means investors don't typically buy gold believing they're going to see explosive gains like they might in, say, a high-flying tech stock.

But that doesn't mean explosive gains can't happen -- case in point, the last three months.

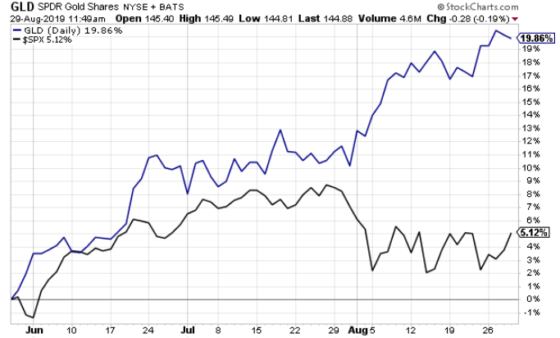

One of the most popular ways to invest in gold is the SPDR Gold Shares ETF (GLD). It's designed to track the price of gold. As you can see below, in the past three months, it has surged 20%, dwarfing the S&P's return of 5%.

Pretty nice?

But do you know how you could have done even better in gold over the last three months?

Gold miners.

The chart below shows the same S&P and GLD performance as above. But now it includes GDX, which is the VanEck Vectors Gold Miners ETF.

As you can see, it has exploded 46% in three months, crushing both market and gold returns.

We've been talking about gold a lot in the Digest this year. It was all the way back in January that we first brought up the "stealth" bull market in gold -- well, it isn't all that stealthy any more.

When we talk about gold here in the Digest, we usually reference it in the general sense, mostly noting gold's spot price. But there are different ways for investors to play gold, and gold miners can be an especially lucrative way. Think of them as "gold on steroids."

In today's Digest, let's dig just a bit deeper into miners as an investment vehicle you might consider as this gold bull continues gaining steam.

***Miners live by leverage and die by leverage

Gold mining can be tricky.

Finding this precious metal takes talent and experience. That's the job of exploration/mining companies. They head out into the field with tenured geological teams to scour the earth for deposits, conducting estimates and studies. All of this requires patience, time, and a lot of money.

But the thing is, actually finding gold can have varying payoffs based on gold's market price at that time. When gold's price is soaring and a miner has found a new gold vein, then that elevated gold market-price enables the miner to pay off the various exploration costs and have plenty of profits left over.

On the other hand, if gold's market price is in the toilet, then even if a miner has found gold, the depressed market price may be so low that it can't adequately cover the cost of getting the gold out of the ground and paying all the related expenses.

Given this relationship, we often say that gold miners are a "leveraged" way to play changes in gold prices. When times are good for gold, times are usually great for miners. But when times are bad for gold, well, lots of miners don't survive.

***A deeper dive into gold mining leverage

John Doody is a legendary gold investing expert, and editor of Gold Stock Analyst, published by our sister-organization, Stansberry Research. He recently explained this dynamic in greater detail to his subscribers.

From John:

... the best gold stocks have leverage to gold prices. This happens in two ways ...

1. Operating leverage

Suppose a miner's output is 100,000 gold ounces a year, and this amount costs $1,200 in labor, power, and materials to produce. If the gold price is $1,400 per ounce, the company's operating profit is $1,400 minus $1,200 times 100,000, or $20 million.

If gold rises to $1,600, the cost to produce doesn't change ... But operating profits double to $400 per ounce, or $40 million total. And if 50 million shares are outstanding, profit per share doubles, from $0.40 to $0.80. The stock price will rise to reflect this.

2. Asset leverage

Miners typically have 10 or more times their annual production in reserves. So for our example, the miner would have a minimum of 1 million ounces still in the ground.

At $1,400 per ounce, that gold has a gross value of $1.4 billion. At $1,600 per ounce, its value is $1.6 billion, an increase of $200 million. Again, if a company has 50 million shares outstanding, each would now be worth $4 more based on the value change. This, too, will show up in an increased stock price. So, what does this leverage look like on an actual "historical market returns" basis?

On December 31, 2001, gold was trading at about $280. It had been losing value over the preceding seven years.

But then gold made its move. Fast-forward about 10 years and it peaked at roughly $1,890 in 2011. That's growth of about 575%.

Now, this was a huge rally for sure. But given how miners are leveraged to the price of gold, their move was even more explosive. From the 2000 low to the 2011 high, gold mining stocks, as measured by the Gold Bugs index, climbed roughly 1,500%.

| You'll never believe where gold is headed next | | Gold expert John Doody just shared his newest prediction of where gold is headed next. Along with the secret behind a gold-investing strategy that has made him more than $20 million ... complete with an oceanfront Florida mansion, a Ferrari 360 Spider, and a 45-foot luxury Italian speedboat. Find out how he did it here. | | SPONSOR AD |

***The broad point of all this is simple -- when times are good for gold, times are often great for the best-run, best-managed gold mining companies

John puts it this way:

At Gold Stock Analyst, we think the best way to profit in gold is to own gold stocks. And we have the track record to prove it.

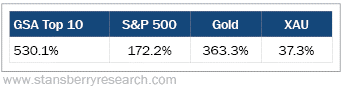

Our independently audited 18-year track record shows a total gain of 530% in our Top 10 gold stock recommendations... triple the return of the S&P 500 Index, and double that of gold.

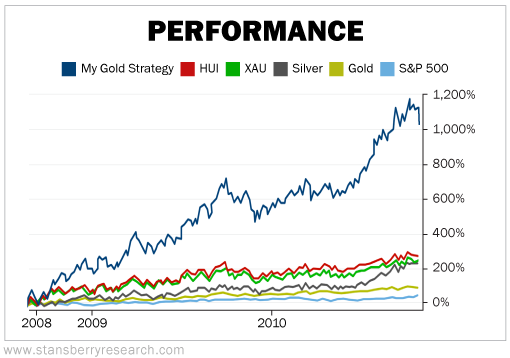

That's why we love gold stocks. A selection of the best gold stocks can deliver market-beating returns over the long term... even through bull and bear markets. Take a look at our outperformance over the past 18 years and see for yourself...

Even better, when in a gold bull market like the one we're in today, the returns can be absolutely spectacular.

During the last gold bull market -- a period of a little more than two years following the crash of 2008 -- the Gold Stock Analyst Top 10 was up 1,070%. That's four times more than any other gold investment ... and 22 times more than the S&P 500.

Gold is making a big move today. And by many long-term indicators, there's still a great deal of room to continue higher. But for the most explosive gains, look to the mining companies themselves. As gold's price continues to climb, the best-in-breed miners should provide far greater returns.

For more analysis of gold from John, as well as his favorite miners, click here. And from all of us here at InvestorPlace, have a wonderful long weekend with your family and friends.

Have a good evening,

Jeff Remsburg

Editor's note:

To make the biggest profits when gold is soaring, you want to own high-quality gold stocks.

And nobody is better at finding those opportunities than legendary investor John Doody.

Today, he believes the precious metal is on its way to $2,500 an ounce ... or more.

In fact, he's guaranteeing that he can help you at least triple your money on one of his top gold ideas, starting now.

You can find more details right here.

|

Comments

Post a Comment