| |  | | | | | |

Some of the biggest gains in investing come from venture capital. But that doesn't mean you can't get VC-like returns in the stock market

The largest ever private acquisition of a VC-backed company happened in 2014, when Facebook bought WhatsApp.

The venture capital group, Sequoia Capital, was WhatsApp's only venture investor. So, what did that mean for its payout in the deal?

Sequoia's initial seed investment of $60 million turned into $3 billion.

When Facebook itself moved from being a private to a public company, it also created billions for its early investors ...

Accel Partners and Breyer Capital were two of the earlier investors in the social media giant, then known as "Thefacebook." The firms led a $12.7M Series A back in 2005, taking a 15% stake.

Even though Accel sold $500 million in shares in 2010, guess what its shares had grown to be worth when Facebook went public in 2012?

$9 billion.

One more ...

In 1999, Cisco acquired a tech company called Cerent for $6.9 billion. One of Cerent's earliest investors was the VC, Kleiner Perkins Caufield & Byers, which had sunk in $8 million.

So, what had that seed capital grown to be worth upon the buyout?

$2.1 billion.

The numbers that are a part of a select few, highly-successful VC deals are simply mind-boggling. For the individuals privileged enough to be a part of those deals, it's not just life-changing wealth, it's multi-generational dynastic wealth.

***Stories like this make for entertaining reading, but how might an ordinary investor like you and me try to approximate such gains in our own portfolio?

Well, if you truly want to go the venture capital route, you could become an angel investor, signing up on a private-deal platform like AngelList (angel.co).

Of course, to take part of these private deals, you must be an accredited investor. To qualify as such, you need to have either a net worth exceeding $1 million, not including your primary residence ... or you must have income exceeding $200k in each of the last two years (or $300K joint with a spouse.)

But there's an easier way to access investments with this explosive, game-changing potential -- without this accreditation financial hurdle.

How much potential, exactly?

Well, how does 2,043% sound? Or 2,772%? Or 2,235%?

These are actual returns from trades dug up by our own Matt McCall.

He found them in the part of the stock market that most resembles the private, venture capital world ... the often-overlooked corner we'll discuss in today's Digest ...

Microcaps.

***The microcap world is where fortunes can be made practically overnight

To make sure we're all on the same page, the "cap" part of microcap refers to capitalization, which is a measure of size -- specifically, it's the size of the value of a company's outstanding shares. You find market cap by multiplying the number of existing shares by the price per share.

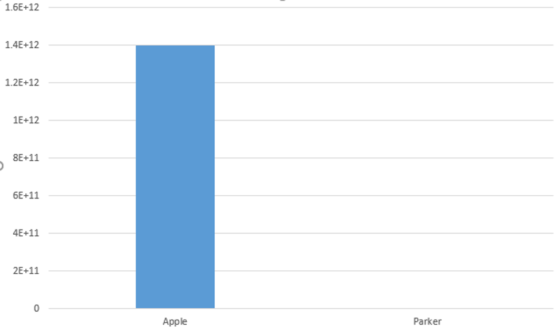

Of the stocks that are readily-available to trade out in the market today, you have "mega-cap" stocks like, say, Apple. Its market-cap is around $1.4 trillion as I write.

Then there are teeny, tiny "micro-cap" stocks like, say, Parker Drilling Company. Its public value is worth about $270 million at the time of this writing.

Microcaps typically refer to companies with market caps between $50 million and $300 million.

Out of curiosity, I graphed Apple's and Parker's market caps side-by-side in Excel, wondering if they'd even be comparable. Keep in mind, Parker is on the "larger" side for a microcap.

Nope ... not comparable at all.

Parker is so small relative to Apple, you can't even see it on this scale.

But great things often come from humble beginnings -- and who knows, perhaps 10 years from now Parker will be a massive company with a colossal market cap.

And therein lies the game-changing potential of early investing in microcaps ...

With smaller size comes the potential for massive growth.

To get a better feel for this, let's turn to our own Matt McCall.

| Investing Legend Says BUY These 9 Microcaps for 2020 | | Self-made millionaire Matt McCall spent two decades investing in microcaps on behalf of institutional clients. A single microcap pick Matt made could've turned $10,000 into a rare $277,000. Now he's going public with a new project to help mainstream Americans have the chance to cash in on this lucrative market too. Click here for more. | | SPONSOR AD |

***In Wednesday's issue of his free newsletter, MoneyWire, Matt delved into the huge gains that can come from elite microcaps

From Matt: When it comes to extreme wealth creation, few endeavors can compare to being an owner of a small company that grows large.

An early investor in Microsoft (MSFT) could have made over 9,000% during the 1990s. That type of gain turns every $5,000 invested into $450,000.

The same pattern repeats all the time. Nowadays, Microsoft is a big blue chip, one of the market's heavyweights. It's a fixture on the Dow, and just last year, Microsoft was one of its best performers, up 55% (versus 22% for the whole index).

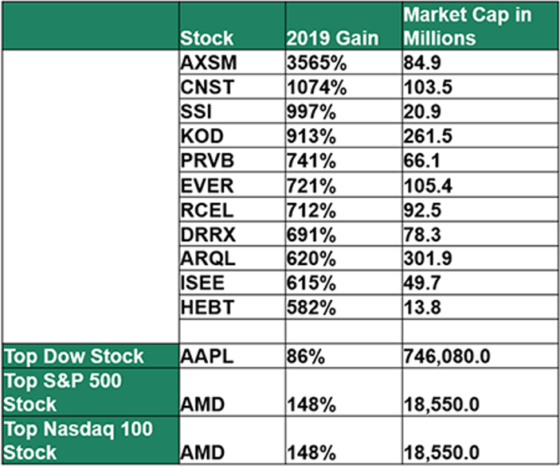

That's some nice outperformance -- but take a look at the best performers in the entire stock market. Now, let me preface the chart we're about to show from Matt.

While your eye will be drawn to the percentage gains in the middle, make sure you don't miss the related market caps on the right.

Spoiler alert -- they're all microcaps (except ARQL, which missed the cut-off by $1.9 million).

Back to Matt: The performance gap between these smaller companies and even the very best Dow stock, Apple (AAPL), was enormous. A simple calculation illustrates just how enormous ...

A $5,000 investment in Apple last year wound up being worth $9,300.

That same $5,000 invested in AXSM (Axsome Therapeutics) would have turned into $178,250.

***Now, what you don't hear as often is how to protect your capital when either venture investing or microcap investing

Sorry for the buzzkill ...

Unfortunately, our goal here in the Digest is to help make you wealthier and wiser -- it's not to tantalize you with stories of huge gains without having a balanced discussion of the inherent risks.

When it comes to venture investing, we usually hear about the monster deals -- what we don't hear about are the countless money-losing deals.

According to an article from TechCrunch, half of all venture investment firms are losing money. In other words, they're sinking more capital into deals than they're generating upon liquidity events.

It makes sense -- not every up-and-coming garage startup is going to become the next Microsoft ... or even profitable, for that matter.

In a loose parallel, not all microcap stocks are going to have blockbuster, thousand-percent gaining years like Axsome Therapeutics ... or even end the year "up."

And this reality points us toward a critical part of investing in microcaps -- the importance of using a basket approach. In other words, spreading your investment capital over a broad portfolio of microcaps, rather than just two or three.

When you do this, just one monster return can more than make up for all the other not-so-great investments.

Back to Matt to understand how this works: ... you're not going to achieve success on 100% of your investments. You probably won't achieve success 75% of the time ... or 66% of the time.

And that's fine.

When you invest like a venture capitalist, you can be right just 33% of the time and still make HUGE returns.

Some simple math shows us how it works ...

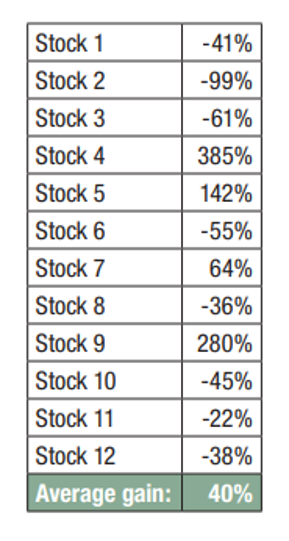

Let's look at a hypothetical investment example.

On December 1st, you structure a "venture capital" portfolio of 12 promising businesses. You hold them for a year. The returns of these 12 stocks are listed below.

In this example, four went up and eight went down. You were right 33% of the time. But because you hit just a few big winners, you made a great average return of 40% across the 12 positions. Now, keep in mind, the highest-returning stock in Matt's example above is 385%. Think of how the average number for the entire portfolio would change if that stock had actually been AXSM, coming in at 3,565%.

Had that have happened, it wouldn't have been the first time. That's because Matt has found thousand-percent gainers before.

Earlier in this Digest, I referenced three monster winners in his past. Here are the details from Matt: These microcap stocks are where I've found the best trades of my career:

* After a friend tipped me off to Ulta Beauty (ULTA), I researched the business, and my Ulta recommendation soared 2,043%!

* Similarly, Stamps.com (STMP) rose a rare 2,772% ...

* And Advanced Micro Devices (AMD) grew 2,235% in its earlier days!

***Next, Wednesday, February 5th, Matt is holding a special event on a new market strategy involving microcaps

It's called the Microcap Millionaire.

Here's Matt on three things he'll be discussing in his presentation: 1. The #1 mistake investors are making in the bull market right now, which could end up costing you tens of thousands of dollars. I will show you how to avoid falling into this trap.

2. The top sectors and industries in which to find microcaps for rare 2,500% gains or more in the years to come.

3. And details on how to claim my new Microcap Millionaire Portfolio. This is a model portfolio of my nine favorite microcap recommendations to own right now. To RSVP for the event, just click here.

Have a good evening,

Jeff Remsburg

P.S. America's #1 Microcap Expert Is Launching a New Research Project to 'Boost' Your Gains ...

Self-made millionaire Matt McCall spent two decades investing in microcaps on behalf of institutional clients. A single microcap pick Matt made could've turned $10,000 into a rare $277,000.

On Wednesday, February 5, he's launching the Microcap Millionaire Project, a new project to help mainstream Americans learn how to cash in on this lucrative market too.

Matt says 2020 will see new stock market gains so big and explosive, it's going to be one of the most powerful wealth-creation forces we've ever seen. But if you're only buying index funds or blue-chip stocks, you're going to miss out the biggest, most lucrative gains.

The Microcap Millionaire Project is free to attend -- simply click here to reserve your spot now.

|

MANAGE YOUR INVESTORPLACE ACCOUNT: We hope this timely investing advice is valuable to you. As you know the markets move fast and conditions change frequently. So please check the current issue for the most recent advice. To make sure you received the most recent updates, please tell us if your email has changed by emailing us at feedback@investorplace.com. Go here to unsubscribe. InvestorPlace Media, LLC.

9201 Corporate Blvd, Suite 200

Rockville, MD 20850 If you have any questions call 1-800-219-8592. Copyright © 2020 InvestorPlace Media, LLC. All rights reserved.

Please note that we cannot be liable for any missed bulletins caused by overzealous filters. To ensure that you continue to receive this valuable part of your service please take a moment to add (Investors_Insights@investorplace.com) to your address book. Go here for instructions:

http://www.investorplace.com/whitelist.html?eml=Investors_Insights@investorplace.com | |

Popular posts from this blog

As your guide, I will explain effective canvas fabric treatments . Achieving reliable waterproofing depends on choosing the correct agent—like wax, silicone, or acrylics—matched to your specific canvas material and its function. This protection is fundamental for extending the life of canvas items exposed to weather, including applications like outdoor gear , protective covers (like boat covers ), apparel, and awnings . The process requires meticulous application onto clean, dry fabric. Sufficient time for the treatment to cure fully is necessary for bonding. Maintaining the treated canvas involves regular cleaning and periodic reapplication. I will detail the required steps: selecting the appropriate canvas type , identifying the best waterproofing methods, executing the application steps correctly, and understanding long-term fabric care . Key Takeaways: Identify your canvas type (cotton, synthetic, blend) to choose the best-suited treatment . Select a t...

PLUS: 6 Vanguard ETFs to Build a Better Portfolio InvestorPlace Insights 7 Troubled Dividend Stocks With Yields Too Good to Be True By Louis Navellier Usually there's a trade-off between great rewards and great risks. These dividend stocks are perfect examples of that. READ MORE 6 Vanguard ETFs to Build a Better Portfolio By Neil George If you want to build a solid portfolio within the Vanguard ecosystem, these are six great funds to start with. READ MORE America's #1 Penny Pot Stock to Explode by December 31? Right now, this pot stock trades for under 50 cents per share. But industry insiders are now predicting it could easily rival the rise of Tilray, Aurora and Canopy Gro...

When it comes to AI, most have one question: How in the world do you invest in it?͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏...

|

Comments

Post a Comment