| |  | | | | | |

How a numbers-based approach made a fortune in Tesla ... and how a similar market approach can lead to huge returns for you

It's a tale of two time-periods ...

Here's the chart of Tesla -- one of the most polarizing stocks of all time -- from one year ago, through the end of September last year. In other words, the first three quarters of 2019 ...

Down 21% -- which, though painful, is far better than the "down 40%" which Tesla investors had to sit through earlier that summer.

But fortunes were about to change ...

Here's Tesla from the first day of the fourth quarter of last year, through yesterday ...

That's a staggering gain of nearly 275% in less than three months.

What if you'd had a stock system that would have gotten you into this trade?

Jim Simons did ... and he likely raked in somewhere between $1.5 and $3 billion because of it.

***The extraordinary success of Jim Simons and his numbers-based trading system

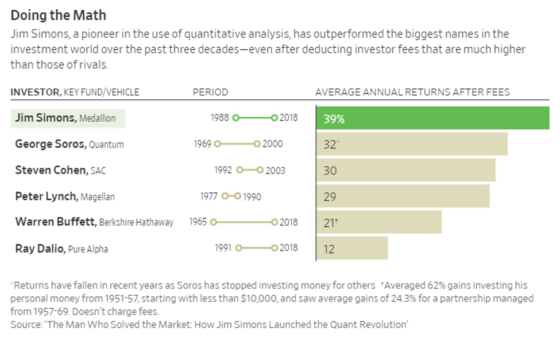

Investors like Warren Buffett and George Soros enjoy the limelight, but when it comes to returns, no one tops Jim Simons.

Starting in 1988, his flagship Medallion fund has racked up average annual returns of 66%, generating trading gains of more than $100 billion.

No other marquee hedge fund manager even approaches that number. See for yourself below (by the way, realize that you're seeing after-fee returns to investors).

It turns out, he just did it again with Tesla.

According to SEC filings, Simons' investment company purchased 3.3 million shares of Tesla sometime in the fourth quarter of 2019.

Given Tesla's meteoric rise over those months and here into 2020, Simons could have pocketed between $1.5 and $3 billion -- depending on exactly when he bought, and whether he's already taken profits or still holding.

***So, let's just jump straight to the question we're all wondering -- how has he done this?

It turns out, there's a simple explanation ...

Numbers.

Simons began his investment career with practically zero investment experience. He was a distinguished mathematician who simply decided to try his hand at trading currencies. Turns out, it didn't go that well at the beginning.

From The Wall Street Journal: For a while, Mr. Simons traded like most everyone else, relying on intuition and old-fashioned research. But the ups and downs left him sick to his stomach. This pointed Simons toward a different approach, one that incorporated his mathematical abilities.

In short, he built a high-tech trading system guided by preset algorithms -- basically, step-by-step computer instructions. It was a program designed to digest vast quantities of market data from which it would then select attractive trades. The goal was to remove human emotion and instinct from the investment selection process.

Simons told a friend, "I don't want to have to worry about the market every minute. I want models that will make money while I sleep. A pure system without humans interfering."

***If this sounds, familiar, it's because our own Louis Navellier shares some striking similarities with Simons

From Louis: I'm a numbers guy. Always have been. Since I was a kid, I've loved math and I knew that math was the right way to understand the world.

Said another way, I depend on evidence for my decisions.

I depend on an objective set of criteria that signals what I should buy, when I should buy it, and when I should sell and collect the profits. Even as a young investor, Louis turned to math and computers for better results, and he's never looked back.

He's now been at it now for 40 years, spending millions of dollars, countless man-hours, and trillions of gigabytes of computing power, to create numbers-based, algorithmic approach to investing.

You could think of these algorithms as highly-detailed formulas -- math-based rules that analyze millions of data points on over 5,000 stocks daily. The goal is to find those select, elite stocks that are poised to explode, similar to Tesla.

Louis calls this his Quantum Scoring formula. He gives it the credit for much of his investment success over the last 40 years -- resulting in profits that have made him and his clients millionaires, several times over.

But even better, it's made them millionaires with far greater peace along the way.

You see, one of the most overlooked-yet-beneficial attributes of a numbers-based system is it takes the burden of the decision off the shoulders of the investor. "Should I buy now or wait in case it drops?"

"Is it time to sell to lock in profits, or is it going higher?" If you're relying on your own hunches and intuition, these questions can produce a great deal of stress. But a numbers-based approach does all the heavy-lifting for you. You simply allow cold, impartial numbers to guide your market decisions.

***An invitation to join Louis to learn more about this market approach

Next Wednesday, at 7:00 PM EST, Louis will be holding a special event called the 2020 Breakthrough Stocks Summit.

He'll be discussing his Quantum Scoring formula, and how, when applied to small-cap stocks, the returns can be explosive.

To make sure we're all on the same page, a "small cap" stock simply refers to a stock's size -- its "market capitalization." When you think of a company like Apple, you're thinking of a large-cap stock. As I write, it has a market cap of about $1.4 trillion.

Small-cap stocks typically fall into a market-cap range of $300 million to about $2 billion. As you can see, Apple dwarfs these little stocks.

The great thing about investing in a small-cap stock is that the gains are potentially far greater -- and come far quicker.

For example, a new sales contract could potentially shoot profits 50% higher for a small company, literally overnight ... whereas that exact same sized sales contract would be just a drop-in-the-bucket for a giant company, having no material effect on its profits.

Think about what a 50% increase in profits would do for a stock's price ...

On Wednesday, Louis will be getting into the details of his approach -- what he calls "my proven blueprint that helped my system average 1,133% in winning gains, every year, for 15 years straight ..."

From Louis: ... this live event will give you everything you need to learn how to start collecting market-crushing returns over the next few years.

In fact, I'm so confident my system and research is going to work for you, I'm going to make the biggest and boldest guarantee of my career.

You won't want to miss it!

To reserve your seat at this free event, just click here. At a minimum, join us simply to learn more about a numbers-based approach. As the multi-decade, extraordinary results of Louis and Jim Simons illustrates, a quantitative approach to the markets is one of the most powerful wealth-building strategies available to investors today.

Have a good evening,

Jeff Remsburg

P.S. On February 26, Louis Navellier is releasing the name of his #1-rated small-cap stock of 2020 ... live on camera.

Louis Navellier's readers saw an extraordinary 1,125% gain on one of his recent #1 recommendations ...

And on Wednesday, February 26, he is going to show you exactly how he did it.

Louis is hosting a FREE webinar that will reveal the system that helps him find dozens of small-cap stocks on the verge of a major breakout ...

And he'll even name his #1 stock that could become his next 10 bagger.

Simply click here to register for this FREE event.

|

MANAGE YOUR INVESTORPLACE ACCOUNT: We hope this timely investing advice is valuable to you. As you know the markets move fast and conditions change frequently. So please check the current issue for the most recent advice. To make sure you received the most recent updates, please tell us if your email has changed by emailing us at feedback@investorplace.com. Go here to unsubscribe. InvestorPlace Media, LLC.

9201 Corporate Blvd, Suite 200

Rockville, MD 20850 If you have any questions call 1-800-219-8592. Copyright © 2020 InvestorPlace Media, LLC. All rights reserved.

Please note that we cannot be liable for any missed bulletins caused by overzealous filters. To ensure that you continue to receive this valuable part of your service please take a moment to add (Investors_Insights@investorplace.com) to your address book. Go here for instructions:

http://www.investorplace.com/whitelist.html?eml=Investors_Insights@investorplace.com | |

Popular posts from this blog

Plus, Luke Lango's roadmap for investing under Trump November 7, 2024 The Fed cuts interest rates by 25 basis points … Powell sounds dovish … will Trump control Congress? … Luke Lango’s 10-point guideline for Trump 2.0 This afternoon, the Federal Reserve cut interest rates by 25 basis points, bringing the Fed Funds target rate down to 4.50% - 4.75%. While this was widely expected, the real story was Federal Reserve Chairman Jerome Powell and his press conference… It was about as dovish as anything that bulls could want. Powell sounded confident about the condition of both the labor market and inflation… he downplayed the recent run-up in Treasury yields… and he openly praised the strength of the economy. I watched the market’s reaction to his live press conference in real time, noting a s...

When will dominance switch from Bitcoin to altcoins? December 3, 2024 Bitcoin price predictions … why Luke Lango is looking beyond Bitcoin … perspective for crypto naysayers … where to start investing today Let’s begin today with our crypto expert Luke Lango and his forecast for Bitcoin: We think Bitcoin can rally to $120,000 by Christmas. We think this Fourth Boom Cycle has about 12 months runway left, with room for Bitcoin to pop towards $200,000 by late 2025. And we also believe altcoins will start to join the party soon and could soar in 2025, similar to how they soared in 2021. Let’s back up and fill in a few details. Since Trump’s victory on November 6, Bitcoin has exploded 42% and forecasts predict that bigger returns are coming Beneath Bitcoin’s price surge has been record-settin...

A long history of experts being wrong about tech October 12, 2024 ...

|

Comments

Post a Comment