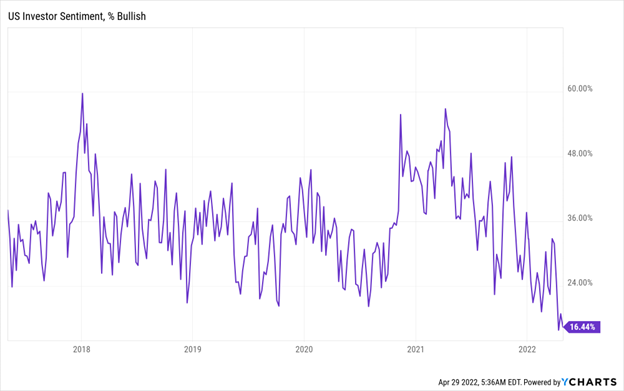

Forget a Recession - The Money-Making Opportunity of the Century Is Knocking on Your Door It's been a wild year for stocks, huh? There's a lot of fear swirling in the stock market, not least of which is a looming recession. But what if I told you all this volatility is creating the money-making opportunity of the century? You'd look at me funny, quite skeptical. And that's fine. Just don't disregard it -- because I have ton of data to prove that claim. Today we're on the cusp of the biggest investment opportunity in the stock market... ever. Yes, I'm aware of all the problems the world is facing today. There's decades-high inflation and a U.S. Federal Reserve that's embarking on the most aggressive tightening path since the 1970s. A Russo-Ukrainian war is raging in Europe. The highest gas and grocery prices are hitting us square in the wallet. There are more Covid-19 lockdowns in China, and the stock market's had its worst start to a year since 1942. Talk about unusual. Talk about volatility. It's downright scary. Against that backdrop, I wouldn't blame you for wanting to run for the hills and take cover from the storm. But the great Warren Buffett once said that it's often best to be greedy when others are fearful. And everyone's fearful right now. The percentage of bullish individual U.S. investors sits at 16.4% today. That's its lowest reading since 1992. It means investors are less bullish today than during the Covid-19 pandemic, financial crisis of 2008 and the dot-com crash. Let that sink in for a moment.

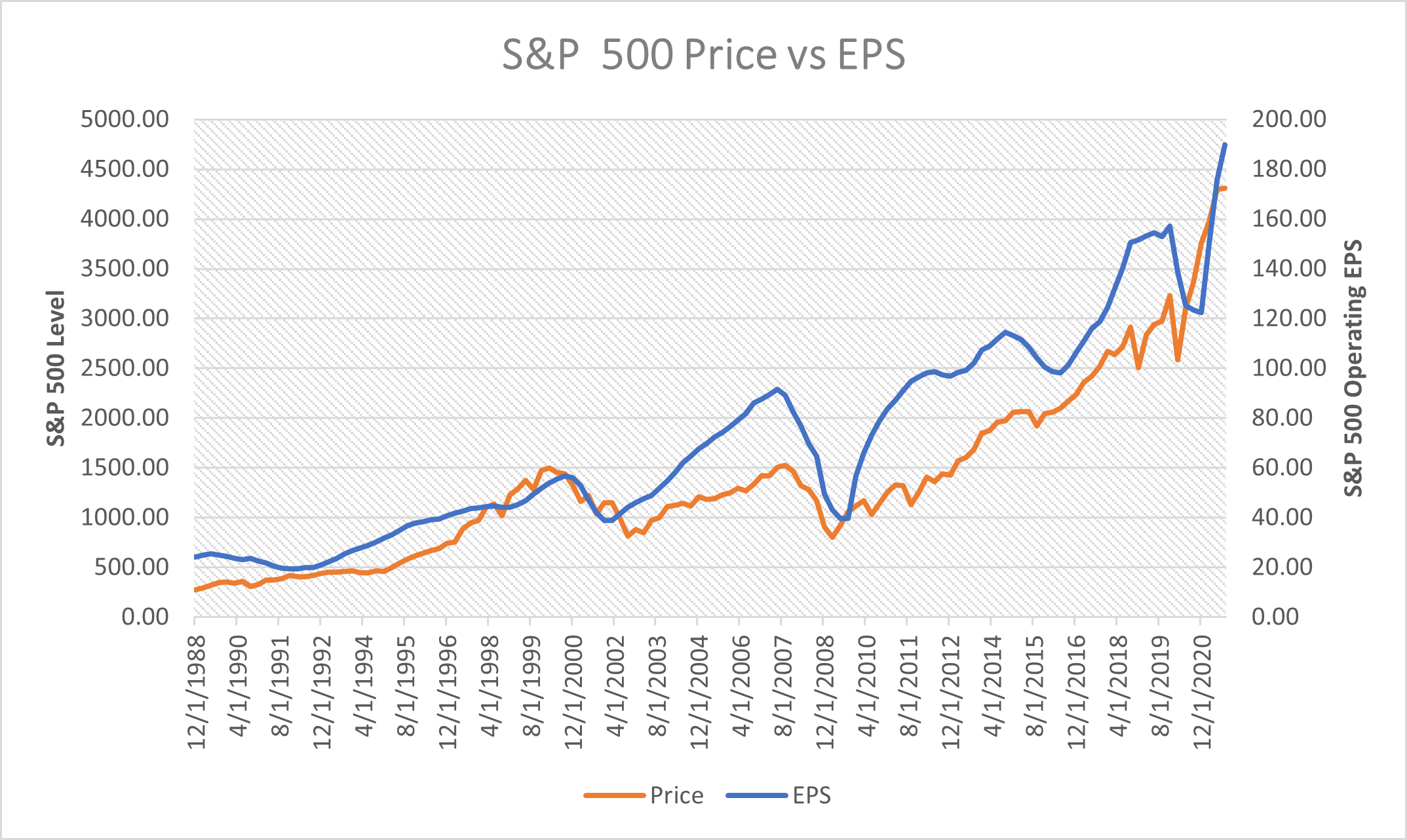

There's nothing but fear out there. And Buffett would tell us to get greedy here. Should we heed those words of advice? Absolutely. The Ultra-Rare Stock Market Phenomenon Over the past several months, my team and I have studied the intricacies of stock market crashes throughout modern history. And we discovered something amazing. Specifically, we've discovered an ultra-rare stock market phenomenon that occurs about once every 10 years. And it consistently provides the best buying opportunities in the history of the U.S. stock market. Moreover, we've figured out how to quantitatively identify this anomaly. Better yet, we've engineered a way to best take advantage of it to rake in massive profits. Well, folks, guess what's happening right now? This ultra-rare market phenomenon is emerging right now. And our models are flashing bright "buy" signals as the window of opportunity to capitalize on it is rapidly approaching. I know. That may sound counterintuitive, given what's going in the markets right now. But I'm staking my career on this claim -- because it's not an opinion. It's a fact backed by data, history, statistics and mathematics. It's backed by the biggest market phenomenon in history. So, I repeat: We stand on the cusp of an opportunity of a lifetime. By now, you're probably thinking, OK, Luke, you have my attention. But where's this proof? I'm glad you asked because I have lots of that. Let's take a deep look. Stock Prices Follow Fundamentals To understand the unique occurrence my team and I have identified, we need to first recognize stocks' behavior pattern. In the short-term, stocks are driven by a myriad of factors, like geopolitics, interest rates, inflation, elections, recession fears. The list goes on. However, in the long-term, stocks are driven by one thing and one thing only: fundamentals. At the end of the day, revenues and earnings drive stock prices. If those fundamentals trend upward over time, then a company's stock price will follow suit and rise. Conversely, if revenues and earnings trend downward, then the stock price will drop. That may sound like an oversimplification. But, honestly, it's not. Just look at the following chart. It graphs the earnings per share of the S&P 500 (blue) alongside the stock price (orange) from 1988 to 2022.

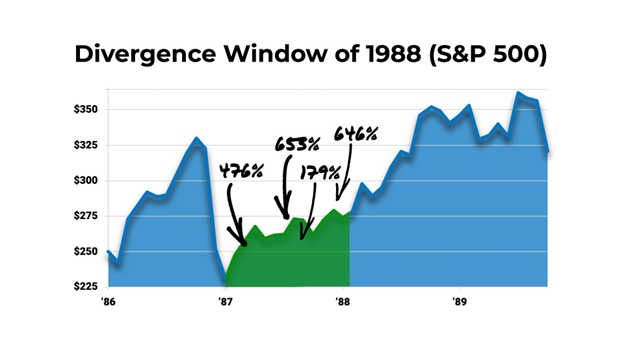

As you can see, the blue line (earnings per share) lines up almost perfectly with the orange (price). The two could not be more strongly correlated. Indeed, the mathematical correlation between them is 0.93. That's incredibly strong. A perfect correlation is one. And a perfect anti-correlation is negative one. Therefore, the correlation between earnings and stock prices is about as perfectly correlated as anything gets in the real world. In other words, you can forget the Fed. You can forget inflation. You can forget geopolitics, trade wars, recessions, depressions and financial crises. We've seen all that over the past 35 years. And through it all, the correlation between earnings and stock prices never broke or even faltered at all. At the end of the day, earnings drive stock prices. History is clear on that. In fact, mathematically speaking, history is as clear on that as it is on anything. Great Divergences Create Great Opportunities The phenomenon my team and I have identified has to do with this correlation. In fact, it has to do with a "break" in this correlation. Every once in a while -- about once a decade -- a rare anomaly emerges in the stock market there earnings and revenues temporarily stop driving stock prices. We call this a "divergence." During these occurrences, companies see revenues and earnings rise, yet stock prices temporarily collapse due to macroeconomic fears. The result is that a company's stock price diverges from its fundamental growth trend. Every time these rare divergences emerge, they turn into generational buying opportunities wherein stock prices snap back to fundamental growth trends. This has happened time and again throughout the history of the markets. It happened in the late 1980s during the Savings and Loan crisis. High-quality growth companies like Microsoft (MSFT) saw stock prices collapse while revenues and earnings kept rising. Investors who capitalized on this divergence doubled their money in a year. And on average, they scored a jaw-dropping ~40,000% returns in the long run.

It happened again in the early 2000s after the dot-com crash. High-quality growth companies like Amazon (AMZN) saw stock prices plunge in the crash. But revenues and earnings kept rising. Investors who capitalized on this divergence more than doubled their money in a year. And they scored more than 20,000% returns in the long term. And it happened during the financial crisis of 2008. High-quality growth companies like Salesforce (CRM) saw stock prices collapse, while revenues and earnings kept rising. Investors who capitalized on this divergence almost tripled their money in year and hit 10X returns in just five years. This is the most profitable repeating pattern in stock market history. And it's happening again now for the first time in 14 years. Volatility Creates Opportunity Market volatility always creates market opportunity. So, over the past six months of the market's wild gyrations, we've made it our priority to research this volatility. We sought to develop a stock-picking strategy to make tons of money in unpredictable markets. That led us to making the biggest discovery in InvestorPlace history: the existence of rare divergence windows. These windows only appear about once a decade amid peak market volatility. They open for very brief moments in time -- and only in certain stocks. But if you capitalize on them by buying the right stocks at the right moment, you can make huge gains. And you can do that while everyone else is struggling to survive in a choppy market. Indeed, these divergence windows give you a real shot at turning $10,000 investments into multi-million-dollar paydays. The more we researched these divergences, the more excited we became. And then we made the biggest discovery of them all: A brand-new divergence is forming right now. |

Comments

Post a Comment