The Next Big Tech Boom Is About to Begin Following last week’s monster stock market rally, the stock market recorded its best week since November 2020. And our Innovation Investor “Top 10” stocks model portfolio jumped 8.4% on Friday alone. I’ve been doing a lot of thinking and research this weekend to discover if this rebound is the “real deal” or not.

My conclusion thus far? It is the real deal.

Why? Inflation.

Or, rather, the lack thereof…

The stubborn and scary rise of red-hot inflation has been the single biggest reason why stocks have crashed in 2022. But, last week, we got confirmation that inflation is decelerating for the first time since 2020.

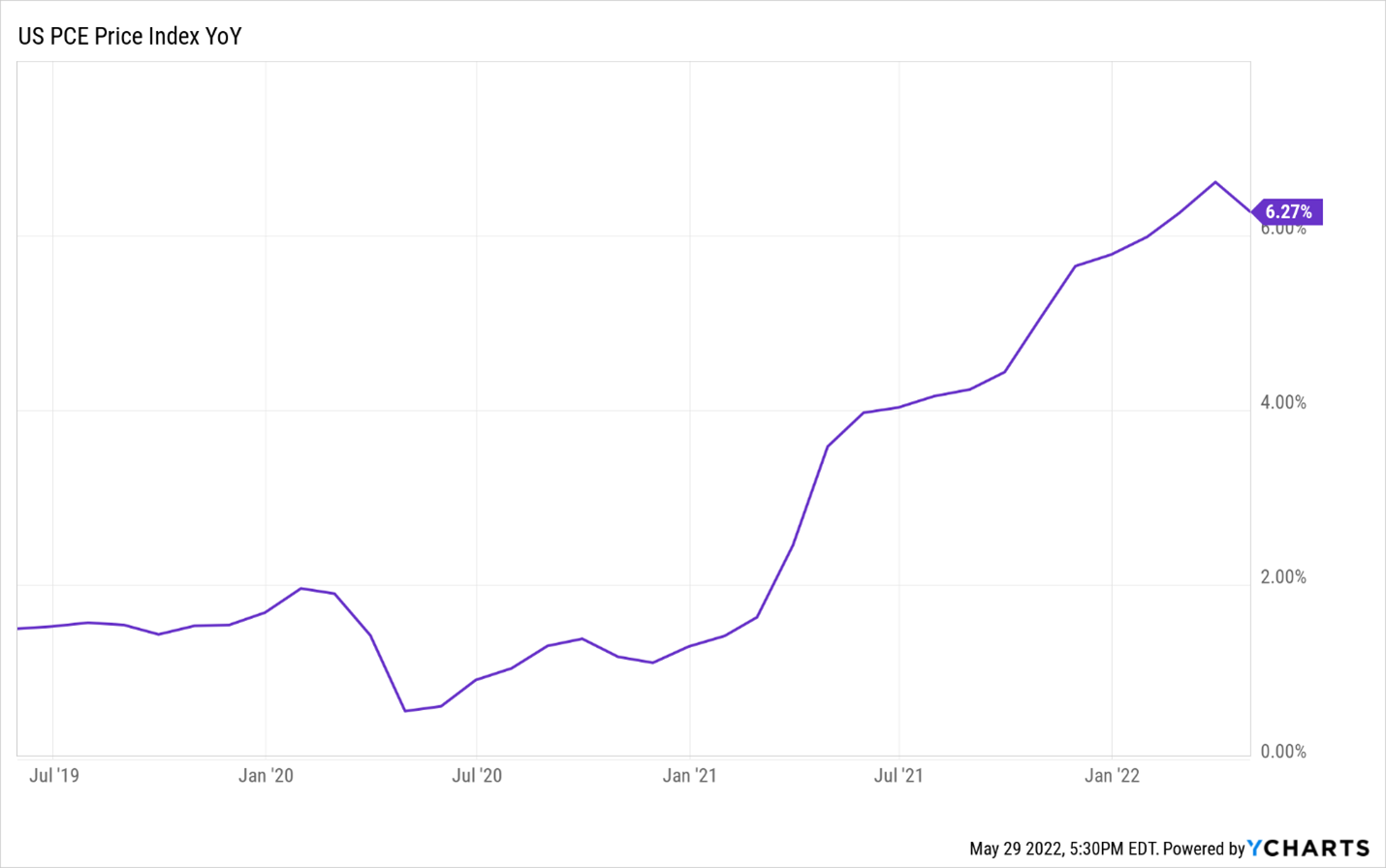

If this new “inflation deceleration” trend persists – and I think it will – then it could be off-to-the-races for stocks over the next six to 12 months. Inflation Is Finally Falling In November of 2020, the annual U.S. inflation rate – as measured by the Personal Consumption Expenditures (or PCE) index – dropped from 1.17% to 1.11%.

That was the last time inflation slowed in this country.

Throughout the last few months of 2020, every single month of 2021, and into the first few months of 2022, the inflation rate in the U.S. economy rose every single month. It was a record 16-month stretch of rising inflation.

But last Friday (just three days ago), this record streak was broken.

The U.S. PCE report for April was released on Friday. It included a U.S. inflation rate of 6.27%, down from the March reading of 6.61%. This means that in April 2022, inflation in the U.S. economy cooled for the first time in 16 months!

That’s important, because rising inflation has been the bane of stocks all year long and the largest driver of the market crash in 2022.

As inflation has gone up, stocks have gone down.

Now, though, inflation is going down. If this trend persists, stocks should storm back in the second half of the year and stage a face-melting rally, particularly inflation-sensitive technology stocks.

Basically, if April’s trend of cooling inflation persists, then it’s time to buy tech stocks for a huge rally over the next six to 12 months.

So… will April’s trend of cooling inflation persist? Lower Inflation Boosts Stocks We’re pretty confident in saying that inflation has peaked, and consequently, tech stocks have bottomed and are due for a huge comeback rally.

The argument here is shockingly simple.

Inflation is a function of supply and demand. Supply is improving. Demand is falling. Therefore, inflation should subside over the next few months.

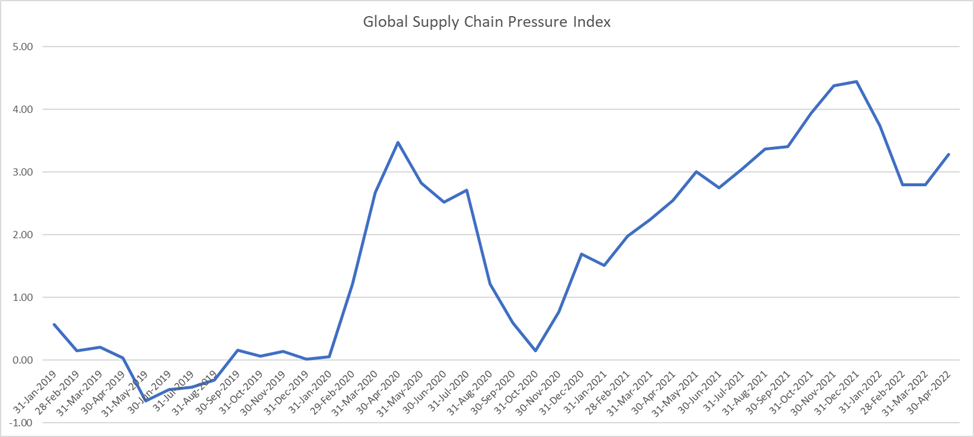

On the supply side, multiple economic datapoints are showing that the COVID-related supply chain disruptions of 2020 and 2021 are gradually subsiding in 2022. Most broadly, the New York Fed’s Global Supply Chain Pressure Index has substantially improved over the past few months in its biggest and longest decline since late 2020:

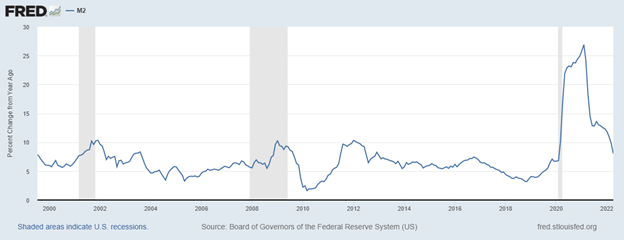

On the demand side, the growth in the volume of money circulating in the U.S. economy is slowing.

Specifically, M2 money supply growth is moderating. During the post-COVID money printing boom, the year-over-year growth in M2 money supply averaged north of 20% throughout 2020 and north of 10% throughout 2021.

But in recent months, M2 money supply growth has dropped into its historically normal ranges of 5% to 10%. It was just 8% last month and is rapidly falling:

With demand falling and supply rising, we think the stage is set for meaningful inflation deceleration in May, June, July, and August. We expect this deceleration to persist into the end of the year, too, and by 2023, we believe inflation rates will fall back to 2%.

In other words, we believe that today we sit at the starting point of a prolonged period wherein inflation falls from 6% to 2%.

Recall: As inflation rose from 2% to 6% over the past few quarters, stocks – and, in particular, tech stocks – have been crushed. As inflation falls from 6% to 2% over the next few quarters, it reasons that stocks – and, in particular, tech stocks – will soar.

In simple terms, it’s time to buy the dip in tech stocks before they surge higher! |

Comments

Post a Comment