Right now, the market is telling us that stocks could be on the cusp of a generational turning point, from bear market to bull market.͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

| |  | | July 29, 2022 |  | Luke Lango

Editor, Hypergrowth Investing | | Daily Issue Apple and Amazon Earnings Confirm Bigger Gains Are Ahead The stock market is in major rebound mode, and we think there are some even bigger gains on the horizon.

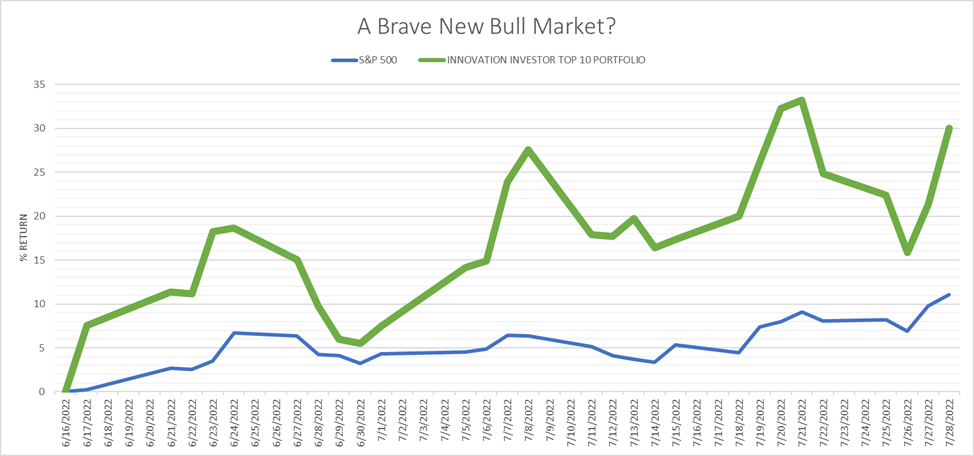

Since mid-June, the S&P 500 is up 11% – an impressive gain for a market that’s been crushed all year long. The top 10 stocks to buy in our Innovation Investor portfolio are faring even better, up a jaw-dropping 30% in just six weeks alone!

We think this could be the emergence of an exciting new bull market for stocks. Our thesis got a shot in the arm last night, when tech behemoths Apple (AAPL) and Amazon (AMZN) both reported excellent earnings.

The former said cloud spending remains robust. The latter said the consumer remains healthy. Both said business operations should improve going forward.

That was enough to juice a big after-hours rally in the stocks. It’s also enough to further convince us that we’re in the early innings of a fortune-making transition from bear market to bull market.

Here’s why. Amazon Says the Cloud Remains Strong On its face, Amazon’s numbers were great from head to toe.

Pretty much everything beat expectations. Physical store revenue. Seller services revenue. Advertising revenue. Cloud revenue. All segments topped revenue expectations. Operating margin topped expectations, too, as did the company’s guide for next quarter.

It was a very clean beat from Amazon at a time when everyone was expecting at least a few misses, given the state of the economy.

The strong numbers underscore two things.

One, the consumer is in a very healthy position, and while they are slowing down, they aren’t slowing down all that much. Two, enterprises continue to embrace digital transformations and spend big on cloud infrastructure.

That’s good news for Amazon stock. It’s also great news for all cloud stocks, which appear to be on the cusp of a big breakout, as we showed you a few days ago.

Amazon’s numbers will only accelerate this breakout. That’s why we believe now is a great time to buy cloud stocks, and we have the best cloud stocks to buy today. Apple Says Sales Trends Should Accelerate Amazon’s numbers were great. Apple’s numbers, on their face, weren’t so great.

iPhone and iPad revenue topped expectations. But Mac and Wearables revenue missed expectations, as did the important Services revenue number. Margins did top estimates, but across the board, the quarter pointed to a meaningfully slowdown in sales momentum.

This slowdown isn’t expected to last.

On the post-earnings conference call, management told analysts that they expect sales momentum to accelerate in the current quarter in a surprisingly bullish call on the consumer – at a time when everyone else appears to be betting against the consumer.

The implication? The consumer isn’t done shopping. They are just focusing their shopping on stuff they want.

That’s why, right now, we aren’t blanket buying consumer discretionary stocks. Instead, we’re only buying the best of the best consumer discretionary stocks – ones that will likely follow Apple and experience accelerating sales momentum this quarter.

Those stocks could pop big over the next few months. | | | | SPONSORED Apple May Help Investors Strike It Rich Once Again Apple is about to unveil their next potential trillion-dollar product… and a Silicon Valley analyst says it could give investors a shot at 40X gains! Learn More | | | The Final Word Don’t fight the market.

That’s one of the important lessons all good investors have learned over the years. When the market is telling you something, listen.

Right now, the market is telling us that stocks could be on the cusp of a generational turning point, from bear market to bull market. That’s why the S&P 500 is up 11% in six weeks. It’s also why our Top 10 stocks portfolio is up more than 30% in those same six weeks.

This is powerful price action. You’d be smart to follow it, mostly because the headwinds that killed stocks in the first half of 2022 – rising inflation, a hawkish Fed, and escalating Russia-Ukraine tensions – are all reversing course.

Inflation has peaked. The Fed is turning dovish. And there has been some serious thawing of Russia-Ukraine relations over the past month.

When headwinds become tailwinds, falling stocks turning into soaring stocks.

We’re at that point right now: Plug into the rally and into some big rebound returns. Sincerely, |  | | Luke Lango

Editor, Hypergrowth Investing On the date of publication, Luke Lango did not have (either directly or indirectly) any positions in the securities mentioned in this article. | | | | |

Comments

Post a Comment