| |  | | September 28, 2022 |  | Luke Lango

Editor, Hypergrowth Investing | | A Note From the Editor: We all know what’s happened in the markets in 2022. It makes us wonder: What if you could’ve known in advance? The good news is that there’s an “advance warning” system out there – never before revealed to InvestorPlace readers – that could have identified every major market move of the past 25 years ahead of time.

This system could issue a new alert at any moment. And we’re giving InvestorPlace readers an unprecedented FIRST LOOK at this system… before its next alert goes out… during a special event on Thursday, Sept. 29, at 4 p.m. ( You can sign up and reserve your spot for that event here.)

Meanwhile, in today’s Hypergrowth Investing, we’ve invited InvestorPlace Editor in Chief Luis Hernandez to share with us how he learned about this system. The Single Most Important Number in Investing Dear Reader,

How many times have you bought a stock…. then sold it a short time later due to a “gut feeling”… only to kick yourself because it went on to skyrocket?

If you’re like most investors, the answer is probably “plenty.”

Well, we can help put a stop to that right now.

I want to tell you a story about a colleague who figured out a practical solution to this problem. You see, he was great at buying stocks… but he was a lousy investor.

Let me show you what I mean…

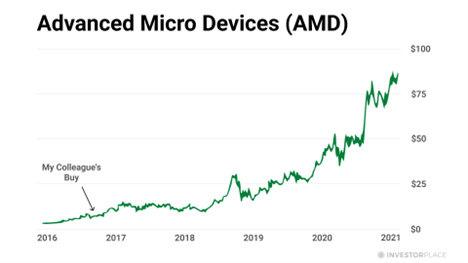

In October 2016, my colleague bought Advanced Micro Devices Inc. (AMD).

This chart makes him look like a genius. AMD has moved up as much as 1,000% since he bought into the stock.

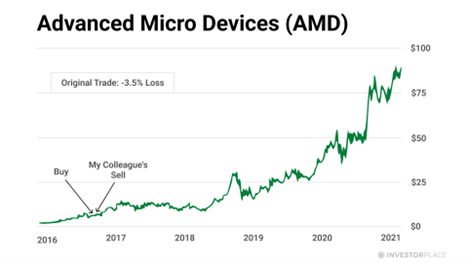

But simply buying a great stock doesn’t make you a great investor. See, nearly right away, my colleague also sold AMD.

Why did he sell it so quickly?

The reason was simple: He trusted his gut.

The same gut that we all use to tell us right from wrong and who to be friends with. It’s that emotional being in us that makes a lot of tough decisions.

Clearly, when it came to AMD, that didn’t work out well. If you’re like most investors, you probably have stories like this, too.

So how is it that we, like my colleague, can buy the right stocks… but wind up being terrible investors?

It’s because using our “gut” is a terrible way to invest.

And in my story, my colleague realized his mistake. He knew that what he really needed wasn’t just a way to pick good stocks but a regimented process for understanding exactly when to buy, how much to buy, and when to sell.

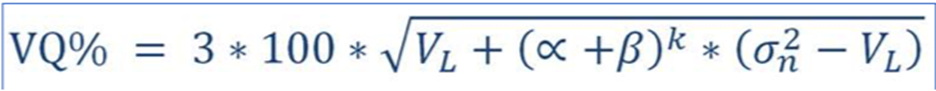

The answer, my colleague says, all starts with this formula:

Here’s how he explained it to me…

| | | | SPONSORED On Sept. 29 Prepare for the Incoming Market Shock Inflation and a bear market are nothing compared to what’s around the corner, and millions are about to be blindsided. Make sure you’re not one of them. On Sept. 29 at 4 p.m. ET, get all the details on what’s about to happen and how to prepare yourself – including the kind of stocks you need to dump immediately, and 10 stocks you’ll want to own. Sign Up Now | | | Make Momentum Work for You It’s all about the findings of two Nobel Prize winners in behavioral economics.

When it comes to their studies around investor psychology – and their work that led to winning the Nobel Prize in Economics – Richard Thaler and Daniel Kahneman are heroes.

Their first finding was that investors are “risk-seeking when we’re losing.” Think of it as “rationalizing your decision after you make it.”

When a stock is falling, you say to yourself: - I’m going to buy this on the dip.

- This stock will come back, and my breakeven price will be lower.

- It’s just a paper loss.

Really, what you’re doing is adding more risk by buying more or holding on to a stock that’s falling. That sort of thinking ignores the single most important factor in investing: momentum.

Here’s what that means: When a stock has a confirmed uptrend, it is more likely to rise in the short term. When a stock has a confirmed downtrend, it is more likely to fall in the short term.

By buying more of a stock as it’s falling, or by “waiting” for that stock to turn around, you are taking on risk and even increasing it. You are setting yourself up to lose more money.

So, how do you combat that? You cut your losses when a stock is in a confirmed downtrend.

But what Thaler and Kahneman found about winning is even more important to understand. They found that when a stock rises, we are “risk-averse when we are winning.”

Typically, when a stock is rising, we get excited. We have a winner, so we decide to sell our stock to “lock in our gains.”

That’s lowering our risk – which sounds good!

But the truth is that when a stock is rising in a confirmed uptrend, you are winning. This is the best time to either ride the winner higher or add even more money to the position to take advantage of its short-term outlook.

This insight is what led to the discovery of the single most important number in investing – and why it works.

This number is the formula I showed you above for the “VQ,” which stands for Volatility Quotient. It’s at the heart of the system my colleague will tell us more about on Thursday, Sept. 29, at 4 p.m. (You can reserve your spot and sign up for that event here.)

And it solves the problem he and so many other investors experience… How Not to Lose Out on 10X Gains VQ is a measure of historical and recent volatility – or risk – in a stock or other security. And that measurement is focused on the moves a security makes.

It tells you: - When to buy a security.

- How much of a security to buy.

- When to sell a security.

- And how risky that security is – how much movement you should expect.

Now, different investors use different strategies to help them make decisions about when to buy and sell, like trailing stops. These act as the point at which you sell a stock.

You ride your winners and cut your losers.

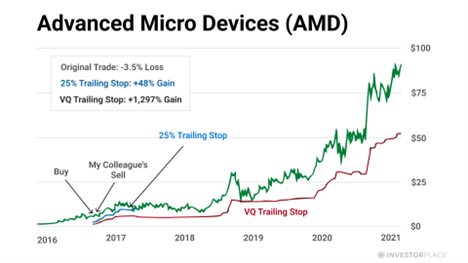

But using a generic trailing stop percentage, such as 25%, only gets you so far. No two stocks are the same.

That’s why you can use the VQ number for each stock you buy to determine exactly what the right stop loss would be.

If my colleague ignored his gut with AMD and just followed a 25% trailing stop, he would have made nearly 50% instead of losing 3.5%. Not bad!

But if he used a VQ-based trailing stop, he could have made more than 1,000%!

Moreover, my colleague’s VQ system doesn’t just analyze stocks and other securities. It can foresee what’s happening in entire markets.

It was dead-on accurate about this bear market… and the Covid crash of 2020. It also could have warned us about every major bear market – and bull market – going back roughly 20 years.

Every time, this system could have alerted you ahead of time, warned you to side-step every downturn, and helped you to get back in at the perfect time.

On Thursday, Sept. 29, at 4 p.m., my colleague – the same man who was great at buying stocks but bad at investing – will explain a lot more about how this system works…

And why any investor, regardless of whether they have $500 or $5 million to invest, can achieve greater gains using the VQ number and this system.

There is no cost to attend and no obligation to buy anything. All we ask is you register for the event by clicking here.

I hope to see you there!

Regards, | | |  | | Luis Hernandez

Editor-in-Chief, InvestorPlace

P.S. This system just issued an urgent prediction – a market shock is imminent. All the details will be revealed at the system’s unveiling on Sept. 29. Join in to stay ahead of the curve and survive what’s next amid the current market turbulence.

| | | | |

Comments

Post a Comment