| |  | | October 30, 2022 |  | Luke Lango

Editor, Hypergrowth Investing | This Is the Money-Making Opportunity of the Century

It’s been a crazy year in the markets, huh? But what if I told you that all of this craziness is actually creating the money-making opportunity of the century?

You’d look at me funny. You’d be skeptical. And that’s fine. Just don’t disregard me, because I have a ton of data to prove that claim. Today, we sit on the cusp of arguably the biggest investment opportunity in the stock market… ever.

Yes, I’m aware of all the problems the world is facing today. Decades-high inflation. A U.S. Federal Reserve embarking on the most aggressive rate-hiking cycle in over 40 years. A Russian invasion of Ukraine. The highest gas prices in decades. The highest grocery prices in decades. The biggest stock market crash since 2008.

Talk about unusual. Talk about volatile. Talk about scary.

Against that backdrop, I wouldn’t blame you for wanting to run for the hills and take cover from the storm. But the great Warren Buffett once said that it is often best to be greedy when others are fearful.

Everyone’s fearful right now.

The American Association of Individual Investors (AAII) weekly survey has found that for two weeks in a row, the percentage of bearish investors in America has outnumbered the percentage of bullish investors by more than 40%. That’s an unusually high number which marks “peak fear.” Indeed, the net bull ratio has been this low only once before: In early March 2009, the exact same week stocks bottomed after the Great Financial Crisis!

Let that sink in for a moment…

There’s nothing but fear out there. Buffett would tell us to get greedy here. But should we heed those words of advice?

Absolutely.

Over the past several months, my team of elite research analysts and I have embarked on an ambitious project to study the intricacies of stock market crashes throughout the history of modern capitalism – and we discovered something amazing.

Specifically, we’ve discovered a never-before-found, entirely rare stock market phenomenon that occurs about once every 10 years and consistently represents the best buying opportunities in the history of the U.S. stock market.

More than that, we figured out how to quantitatively identify this phenomenon. Even better yet, we have engineered a way to take advantage of it for massive profits.

Well, folks, guess what’s happening right now?

This ultra-rare stock market phenomenon has emerged. And our models are flashing bright BUY signals.

I know. That may sound pretty counterintuitive, considering what’s going on in the market right now.

But I’m staking my career on this claim. Because it’s really not an opinion. It’s a fact. Backed by data. Backed by history. Backed by statistics and mathematics. Backed by the biggest market phenomenon in history.

So, I repeat: We stand on the cusp of an opportunity of a lifetime.

By now, you’re probably asking: OK, Luke, you have my attention…but where’s the proof?

Glad you asked, because I have lots of that. Let’s take a deep look. Stock Prices Follow Fundamentals To understand the unique phenomenon my team and I have identified, we need to first understand the behavior patterns of stocks.

In the short term, stocks are driven by several factors. Geopolitics. Interest rates. Inflation. Elections. Recession fears. So on and so forth.

In the long term, however, stocks are driven by one thing and one thing only: fundamentals.

That is, at the end of the day, revenues and earnings drive stock prices. If a company’s revenues and earnings trend upward over time, then the company’s stock price will follow suit and rise. Conversely, if a company’s revenues and earnings trend downward over time, then the company’s stock price will drop.

That may sound like an oversimplification. But, honestly, it’s not.

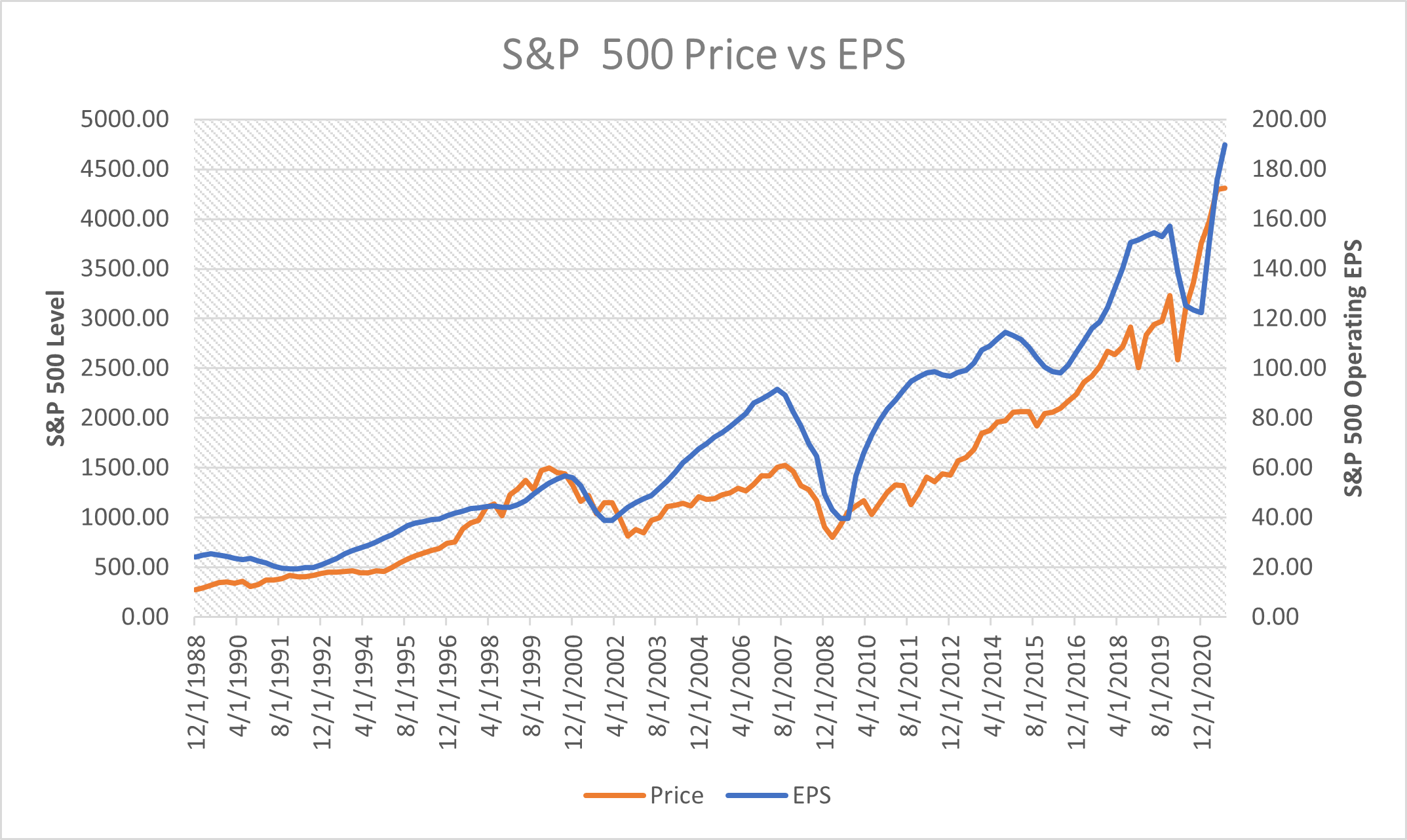

Just look at the following chart. It graphs the earnings per share of the S&P 500 (the blue line) alongside the price of the S&P 500 (the orange line) from 1988 to 2022.

| | | | SPONSORED NOW OPEN: After eight months, it’s finally here… After eight months of late nights and long weekends, Luke has finally released his highly anticipated new research. This research could help you generate an extra 100,000 or more in cash over the next 12 months, here’s how. See the full story here | | | | As you can see, the blue line (earnings per share) lines up almost perfectly with the orange line (price). The two could not be more strongly correlated. Indeed, the mathematical correlation between the two is 0.93. That’s incredibly strong. A perfect correlation is 1. A perfect anti-correlation is -1.

Therefore, the historical correlation between earnings and stock prices is about as perfectly correlated as anything gets in the real world.

In other words, you can forget the Fed. You can forget inflation. You can forget geopolitics. You can forget trade wars, recessions, depressions, and financial crises.

We’ve seen all that over the past 35 years – and yet, through it all, the correlation between earnings and stock prices never broke or even faltered at all.

At the end of the day, earnings drive stock prices. History is crystal clear on that. In fact, history is as clear on that as it is on anything, mathematically speaking.

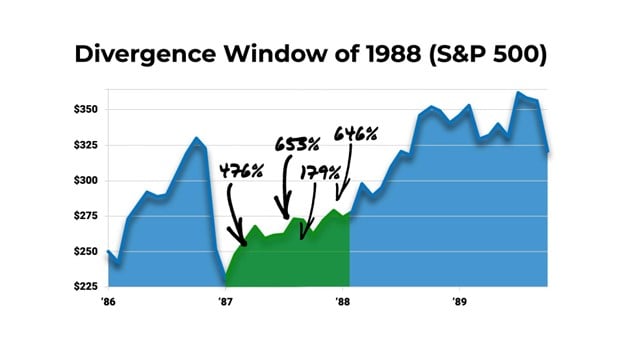

The phenomenon my team and I have identified has to do with this correlation. In fact, it has to do with a “break” in this correlation – a break which historically only arises when recession fears are peaking, and which has produced the greatest stock market buying opportunities in history. Great Divergences Create Great Opportunities Every once in a while – specifically, about once a decade – a rare anomaly emerges in the stock market wherein earnings and revenues temporarily stop driving stock prices.

We call this anomaly a “divergence.”

During these divergences, companies tend to continue to see their revenues and earnings rise, yet their stock prices temporarily collapse due to some macroeconomic fears. The result is that a company’s stock price diverges from its fundamental growth trend.

Every time these rare divergences emerge, they turn into generational buying opportunities wherein the stock prices “snap back” to the fundamental growth trends.

This has happened time and time again, like clockwork, throughout the history of the markets.

It happened in the late 1980s during the Savings & Loans crisis. High-quality growth companies – like Microsoft (MSFT) – saw their stock prices collapse, while revenues and earnings kept rising. Investors who capitalized on this divergence doubled their money in a year, and scored a jaw-dropping ~40,000% returns (on average) in the long run.

It happened in the early 2000s after the Dot-Com Bubble. High-quality growth companies – like Amazon – saw their stock prices plunge in the early aughts. But their revenues and earnings kept rising. Investors who capitalized on this divergence more than doubled their money in a year, and scored more than 20,000% returns in the long run.

It happened in 2008 during the Great Financial Crisis. High-quality growth companies – like Salesforce – saw their stock prices collapse. But their revenues and earnings kept rising. Investors who capitalized on this divergence almost tripled their money in a year, and hit 10X returns in just five years.

This is the most profitable repeating pattern in stock market history. And its happening again right now for the first time in 14 years. | | | | SPONSORED Emergency Zero Hour Briefing Now Available 14 years ago, this mysterious stock market anomaly delivered back-tested gains of 2,150%, 591%, and 861%.

Now, Luke Lango has officially declared a new 1,000% Divergence Window is about to close. Get his #1 Zero Hour recommendation at his emergency briefing with Louis Navellier right now. Learn More | | | The Final Word As a competitor, I love to win.

On game nights, I love to win. In basketball games, I love to win. And in the stock market, I love to win.

My team and I understand that market volatility always creates market opportunity.

So, amid the market’s wild gyrations of 2022, we’ve made it our top priority to research market volatility and develop a stock-picking strategy to make tons of money during volatile markets.

Which is why I’ve developed the ultimate tool to help me always win in the market.

It’s become my favorite investment tool recently. In a few weeks, it may become your favorite investment tool, too.

Learn more. Sincerely, |  | | Luke Lango

Editor, Hypergrowth Investing On the date of publication, Luke Lango did not have (either directly or indirectly) any positions in the securities mentioned in this article. | | | | |

Comments

Post a Comment