͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

| |  | | November 30, 2022 |  | Luke Lango

Editor, Hypergrowth Investing | | Daily Article

The housing market is a mess right now. Without the perfect data, I’d consider anyone who disagreed to be nuts! But we always follow the data, and that data is telling us now is the perfect time to buy housing stocks!

Housing stocks tend to bottom (and then soar) when the housing market is a mess.

Just look to April 2020, when existing home sales dropped more than 15% in the midst of the COVID-19 pandemic. The housing market was a wreck. But the SPDR S&P Homebuilders ETF (XHB) bottomed that same month. It soared about 200% over the next year.

Or look to December 2018, when existing home sales dropped 10% in their ninth consecutive monthly decline. Some investors called for a repeat of the 2008 housing crisis. The market was a mess. But that same month, housing stocks bottomed and then soared more than 50% over the next year.

What about February 2009, when existing home sales dropped for the 26th straight month – the longest streak of declines on record? Housing starts plummeted to a record low. Many wondered if the market would ever recover. Yet, that same month, housing stocks bottomed and then soared more than 100% over the next year.

Do you see the pattern? Housing stocks tend to bottom when the housing market is a mess because the U.S. housing market just happens to be the most resilient in the world. It always bounces back.

And it’s going to bounce back big in 2023. So buy housing stocks today.

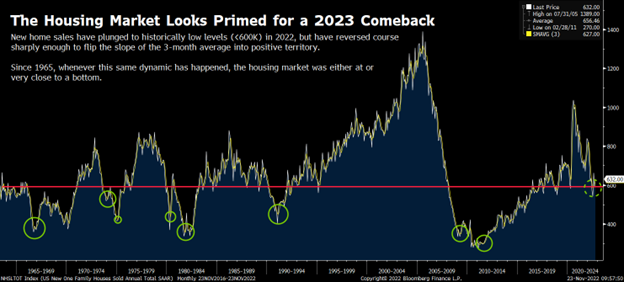

Here’s a deeper look. The Housing Market Is Primed for a Big 2023 Comeback It is our belief that the U.S. housing market is primed to make a substantial comeback in 2023. Falling inflation rates will lead to a dovish policy pivot from the Fed, which will lead to lower interest and mortgage rates. And that will ultimately re-stimulate sidelined home-buying demand.

We believe this comeback has actually already started.

According to Bankrate, the national average 30-year fixed mortgage rate peaked in early November at 7.35%. It has since dropped about 60 basis points to 6.78%. That’s a big drop, and it has sparked a big resurgence in home-buying demand.

New home sales have been declining all year long. But in October, they rose 7.5% month-over-month, far better than the 11% drop expected by analysts.

To us, the big rise in new home sales concurrent to the big drop in mortgage rates tells us that there is a lot pent-up home-buying demand in America. It’s been sidelined in 2022 by soaring mortgage rates. But it’s ready to come flooding back into the market once mortgage rates start to fall.

We expect mortgage rates to collapse in 2023 as inflation falls and the Fed goes from hiking rates to cutting them. As mortgage rates come down, we expect the housing market to rebound.

The rebound won’t be small. A 60-basis-point drop to a still-very-high mortgage rate of 6.8% sparked a 20-point upside surprise in new home sales in a month. What will a multi-hundred-basis-point drop to much lower mortgage rates of 5%, 4%, and 3% do to home sales next year?

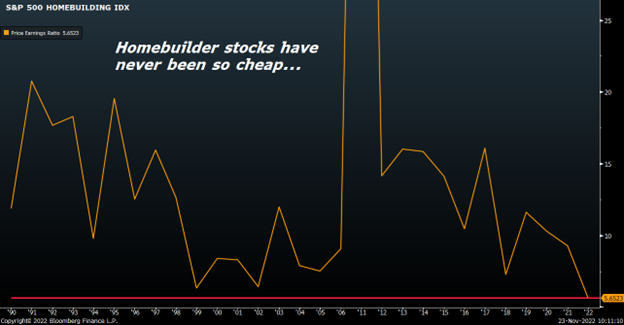

You have to buy housing stocks before that sales surge arrives. | | | | Advertisement Divergence came for investors during the peak of the 2008 financial crisis, the Dot-Com crash, and Black Monday in 1987. Today, Luke Lango – a self-made millionaire and investing prodigy – says this event is just ahead in 2022. If you’re holding onto cash, you’re in for a rude awakening. Get the facts here. Click Here to Learn More | | | Housing Stocks Have Never Been So Cheap One of the reasons housing stocks tend to rebound so much when the housing market is in “crisis mode” is because the stocks get so cheap.

For example, in the 2020 housing market crisis housing stocks were trading around just 10X earnings. Back in 2018, they dropped to about 7X earnings. At their bottom in 2002, they were trading around 6X earnings.

At such low multiples, housing stocks become primed for huge moves higher when the market inevitably turns around.

This is partly why we think the 2023 rebound could be the biggest one yet.

Today, folks, housing stocks are as cheap as they’ve ever been. The S&P 500 Homebuilders sector is trading at just 5.6X trailing earnings.

With housing stocks trading at their lowest valuation ever ahead of a potential massive rebound in 2023, we think the stage is set for housing stocks to have maybe their best year ever next year. | | | | Advertisement While the financial media keeps the masses distracted by the bear market, one Silicon Valley Insider is warning of a far bigger “Divergence” event about to blindside millions of Americans. It came during the height of the Black Monday crash in 1987, Dot-Com Crash in 2000, and the 2008 Financial Crisis. And it’s back again in 2022. Get the facts and get out of cash while you still can! See the full story here. Click Here to Learn More | | | The Final Word We’re super bullish on housing stocks right now. The last time we felt this bullish about the sector? December 2018 – right before those stocks soared more than 50% in 2019.

That’s no guarantee housing stocks will soar in 2023. But the data does strongly suggest as much.

That’s why we’re looking to build exposure to the housing sector here in late 2022. We believe the big turnaround for these stocks will start to materialize in the first quarter of 2023. Inflation will continue to crash, the Fed will pause on rate hikes, and mortgage rates will start to really roll over. That means now – just months before the big turnaround – is the best time to start buying.

We’ve been on a buying spree across all our stock portfolios over the past month, and we think our next round of buys could be in the housing sector.

Are you prepared to capitalize? Sincerely, |  | | Luke Lango

Editor, Hypergrowth Investing On the date of publication, Luke Lango did not have (either directly or indirectly) any positions in the securities mentioned in this article. | | | | |

Comments

Post a Comment