| |  | | December 30, 2022 |  | Luke Lango

Editor, Hypergrowth Investing | |

Source: Shutterstock.com/Nixx Photography Let me cut straight to the chase: If you want to put yourself in a position to potentially make a fortune in the stock market over the next year, you should consider buying electric vehicle (EV) stocks today. Don't worry about inflation, a recession, or the Federal Reserve. The reasoning is simple.

This year, gas prices reached record highs, causing consumer interest in EVs to increase. This increase in interest has led to increased demand and sales of EVs. In the first half of 2022, EV sales rose by more than 60% to a new record.

Furthermore, the cost of EVs is decreasing again (after a brief spike in early 2022 due to the Russian invasion of Ukraine), and more and more automakers are ramping up production of EVs. Additionally, the U.S. government recently passed a $400 billion climate bill, which includes subsidies for EV adoption.

On top of all that, EV stocks are currently as cheap as they have ever been. Add it all up, and the stage is set for EV stocks to potentially soar in 2023. It's possible that a few EV stocks could even increase in value by more than 10 times in the coming year.

However, it's important to note that not all EV stocks will perform well. We believe that EV charging stocks have the potential to be big winners. This is because as the adoption of EVs increases, there will be a corresponding increase in demand for charging infrastructure. The Simple Case for EV Charging Stocks Let me ask you a question: What good is an EV without charge?

No good at all – it’s pretty much useless. It’s a simple conclusion, but inside the simplicity lies the basis for why you should invest in EV charging stocks. They are necessary to the mass deployment of EVs.

Let’s look at the numbers:

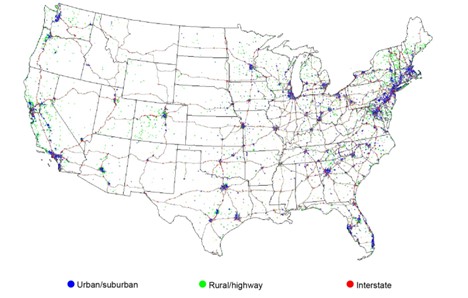

Currently, there are about 130,000 EV charging ports across the U.S. That may seem like a big number, but we’ll need a lot more if everyone’s going to be driving an electric vehicle by 2030.

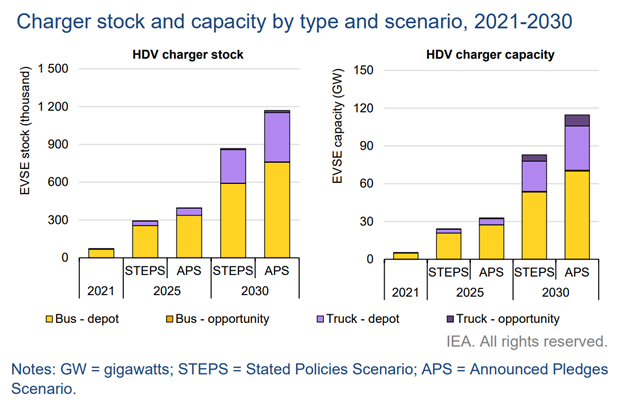

The International Energy Agency estimates that the number of EV chargers globally is going to have to increase by 12X by 2030 in order for companies and governments to reach the low-end of their targets for 30% of new car sales to be electric by then.

The EV charging market is expected to experience significant growth in the next decade, which will lay the foundation for the overall growth of the EV market. That’s why we believe now is a good time to invest in EV stocks, as they have been beaten down by the market downturn like other high-growth stocks. But unlike every other stock in the market, EV stocks are potentially on the cusp of generational hypergrowth in the coming years

Time to buy the dip? We think so.

| | | | SPONSORED The world isn’t prepared for what Apple is about to do… and one of Silicon Valley’s top venture capitalists details the full story. Learn More Here | | | Gaining an “Edge” in EV Charging Stocks Considering what you just read, you’re probably thinking that it’s time to rush out there and buy some EV charging stocks, right?

Not so fast.

There are lots of EV charging companies out there today. Not all of them will make it. Indeed, only a handful of them will make it big. Most will fail. So, it’s not time to buy all EV stocks – rather, it’s time to buy the best EV stocks.

To know which ones are “the best,” let’s first understand EV charging technology.

That analysis starts with the fundamental question: How does electricity work?

In short, we generate power at a power source, like a coal-fired power plant or a solar farm, and then promote the flow of electrons (little charged particles that carry electric power) from that power source to the rest of the world via electric wires. This flow of electrons is called a “current.”

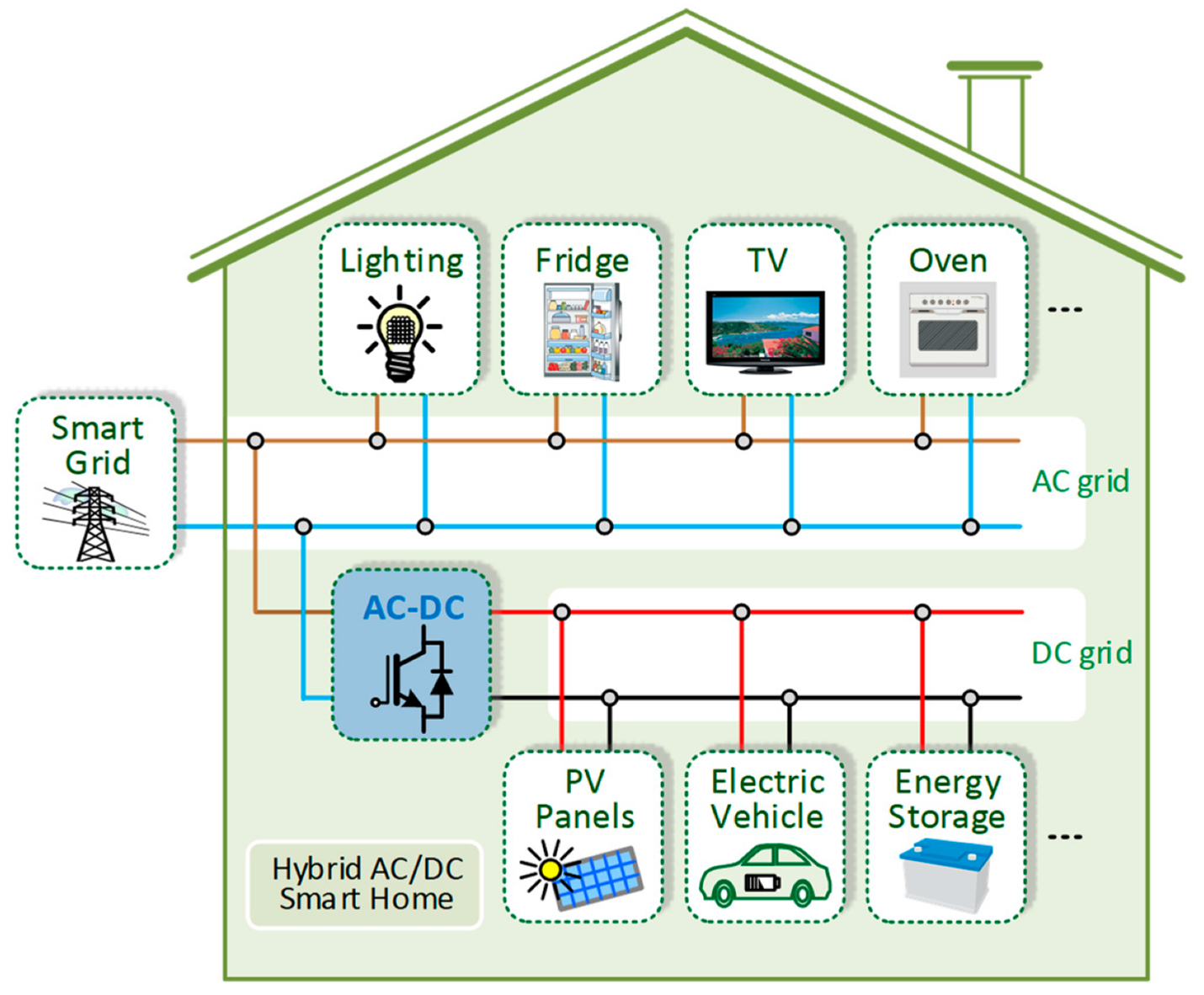

That current can take two forms: Alternating current (AC) or direct current (DC). DC is a direct constant flow of electrons through the wire. It results in heavy power delivery, but also in significant drain on the grid. AC is an oscillating flow of electrons that results in lower power delivery, but a much more manageable load on the grid.

Because the grid is and has always been load-constrained, society decided long ago to build the grid on AC. But today’s batteries can only store power as DC – since AC being an alternating current physically handicaps its ability to store any energy.

That’s why most consumer electronics devices – like laptops – come with power chords that have big boxes in the middle of them. Those big boxes are AC/DC converters which convert the AC power from the grid, to DC power that can be stored in your laptop.

EV charging works in much the same way.

EV chargers plug into the grid, which provides AC power. That AC power is then pumped into the EV. On board every EV, there is an AC/DC converter which converts the AC power from the charger, into usable DC power, which is then stored in the car’s battery. How to Pick the Best EV Charging Stocks Understanding how EV charging works isn’t all you need to know to pick the best EV charging stocks – you need to also know the different types of EV chargers out there, so that you can pick the companies which make the most useful and highest-quality chargers.

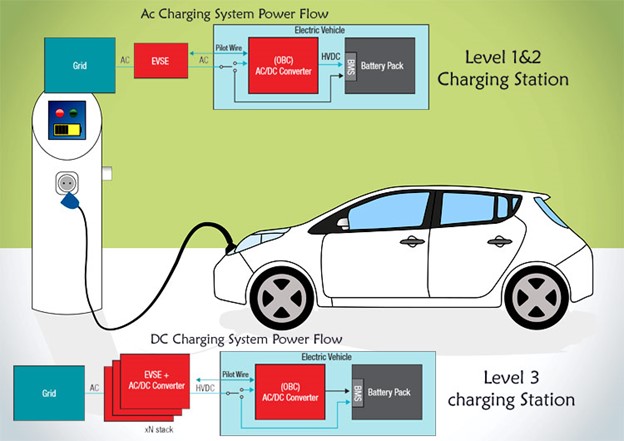

There are two classifications of AC electric vehicle chargers – L1 and L2.

L1 chargers are the most basic chargers out there. They’re really slow, but really cheap. They’ll give you about 3 to 5 miles of EV range per hour of charging. Given that they’re low-cost, low-performance in nature, L1 chargers are common as residential solutions, but are very rarely used beyond the home.

L2 chargers are a big step-up from L1 chargers. They’re much faster, but also much more expensive. They’ll give you maybe 30 miles of EV range per hour of charging. These L2 chargers constitute the majority of chargers on the road today.

There are also DC fast-chargers. These chargers are fundamentally distinct from AC chargers. They have built-in AC/DC converters, which convert AC power from the grid into DC power within the actual charger itself. What this enables, then, is for the charger to pump DC power directly into an EV battery, completely bypassing the AC/DC converter in the car and therefore resulting in a far more powerful charge.

These chargers are really, really fast… and really, really expensive. As a result, they can give you over 100 miles of EV range per hour of charging, but there aren’t many of them on the roads these days – a few thousand across the whole U.S.

Considering this context, it’s important to understand that the future of the EV charging landscape will be a mix of mostly L2 chargers throughout urban areas, and some DC fast-chargers on interstate highways.

That’s because L2 chargers are good enough. The reality is that the enormous shift from gas stations to charging ports will be accompanied by an equally enormous paradigm shift in where we go from “filling up” our vehicles to to plugging them in.

Because EV chargers are tiny and can be built anywhere that there’s an electric connection, the days of dedicated gas stations are over. You won’t see EV charging stations replace gas stations. You’ll see gas stations become extinct, and EV charging ports pop up everywhere, including your gym parking lot, grocery store lot, and local mall parking lot.

In the EV Charging Revolution, you’ll charge your EV everywhere you go. So long as you aren’t traveling hundreds of miles and/or between cities and states, L2 chargers will do the job just fine, because you’ll be charging as you shop or work out.

For those long road trips… well, that’s where DC fast-chargers will be super useful.

Oh, and charging does actually cost money. Right now, it costs about $2 per 30 minutes of L2 charging in a public lot.

To that end, the future of EV charging is super clear: You will have millions upon millions of L2 chargers pop up across every parking lot in urban and suburban areas, while DC fast-chargers will replace gas stations on interstate highways, and consumers will be paying for all that charge.

That’s the future.

So, which EV stocks should you be buying right now to play that future? | | | | SPONSORED Apple is getting ready to SHOCK the world with one last technological marvel from the mind from Steve Jobs. It goes by the code name “Project Titan”... And according to Barron’s... “Wall Street is obsessed” with it. Learn More Here | | | The EV Charging Boom Has Arrived We’ve followed the electric vehicle space closely over the past seven years. In all those years, we’ve seen a lot. But we’ve never seen what we’re seeing right now.

The EV charging industry is “powering up” (no pun intended) right now in a way that it has never done before.

Earlier this summer, General Motors (GM) partnered with EV charging network operator EVgo (EVGO) to build 2,000 EV chargers at 500 Pilot’s locations across the U.S.

Over the past few months, Los Angeles International Airport has commenced the construction of 1,300 EV charging stations across its facilities.

A few months ago, IKEA announced that it will be installing more than 140 EV chargers at over 25 of its U.S. locations.

On a government level, the U.K. government just pledged 20 million pounds to build 1,000 EV chargers across its country, while the U.S. government just passed an elephant-sized climate bill that includes nearly $2 billion in incentives for EV charger construction.

Just a few months ago, the Department of Transportation approved more than $900 million in funding for the construction of hundreds of electric vehicle chargers across 35 states. Over in California, legislators committed an additional $1 billion to building out EV charging infrastructure in the state.

The writing is on the wall. The EV charging industry is on fire right now. So begins a decade of hypergrowth ahead for EV charging station operators. The Final Word The million-dollar question, of course, is: What stocks should you buy to plug into this decade of hypergrowth?

To answer that questions, let’s turn to my team.

Few know this, but I manage a team of hypergrowth technology stock experts – including software engineers, data scientists, seasoned traders, and economists – who understand technological megatrends at their most fundamental level.

We don’t just listen to management teams and read investor decks. We break down every company’s underlying technology at its most elementary level to assess its validity and capability – and its potential to change the world.

We do this across every industry, across every technological breakthrough, and with every company. In a nutshell: We identify early stage hypergrowth tech stocks set for enormous long-term returns.

It’s clear that the electric vehicle industry is growing rapidly and the demand for charging infrastructure is on the rise. Major companies and government agencies are taking action to meet this demand and provide more convenient charging options for EV drivers. This trend is a clear indication that the electric vehicle market is not slowing down, but rather gaining momentum and becoming a more integral part of our transportation system.

And… in the EV industry… we’ve found a few stocks that we’re really excited about.

To find out their names, start here. |  | | Luke Lango

Editor, Hypergrowth Investing On the date of publication, Luke Lango did not have (either directly or indirectly) any positions in the securities mentioned in this article. | | | | |

Comments

Post a Comment