| |  | | April 30, 2023 |  | Luke Lango

Editor, Hypergrowth Investing | Rare Stock Indicators Show the Market Is About to Skyrocket

Back in January, the stock market did something it has never done before. And now, two months later, it could mean that stocks are ready to explode higher in a fashion they only do about once every 10 years.

On the second Thursday of the year – Jan. 12 – the stock market fired off an unprecedented “Triple Barrel” buy signal.

That is, on that day, three major, ultra-rare, and ultra-predictive stock market breadth thrust signals were all triggered – the Breakaway Momentum, Whaley Breadth Thrust, and Triple 70 Thrust indicators.

The Breakaway Momentum indicator is triggered when the number of 10-day advancing stocks in the market exceeds the number of 10-day declining stocks by about 2-to-1. This is very rare and tends to only happen when bear markets are ending and bull markets are starting.

The Whaley Breadth Thrust indicator is triggered when the number of five-day advancing stocks in the market exceeds the number of five-day declining stocks by about 3-to-1. This, too, is very rare and tends to only happen when bear markets are ending and bull markets are starting.

And the Triple 70 Thrust indicator is triggered when the percentage of rising stocks in the market exceeds 70% for three consecutive days. Likewise, this is also very rare. And it tends to only happen when bear markets are ending and new bull markets are starting.

All three ultra-rare, ultra-predictive “bear market ending” technical indicators flashed on the same day in the middle of January. Triple-Barrel Stock Indicators Preempt Mega Rallies That’s the first time ever that all three have flashed on the same day.

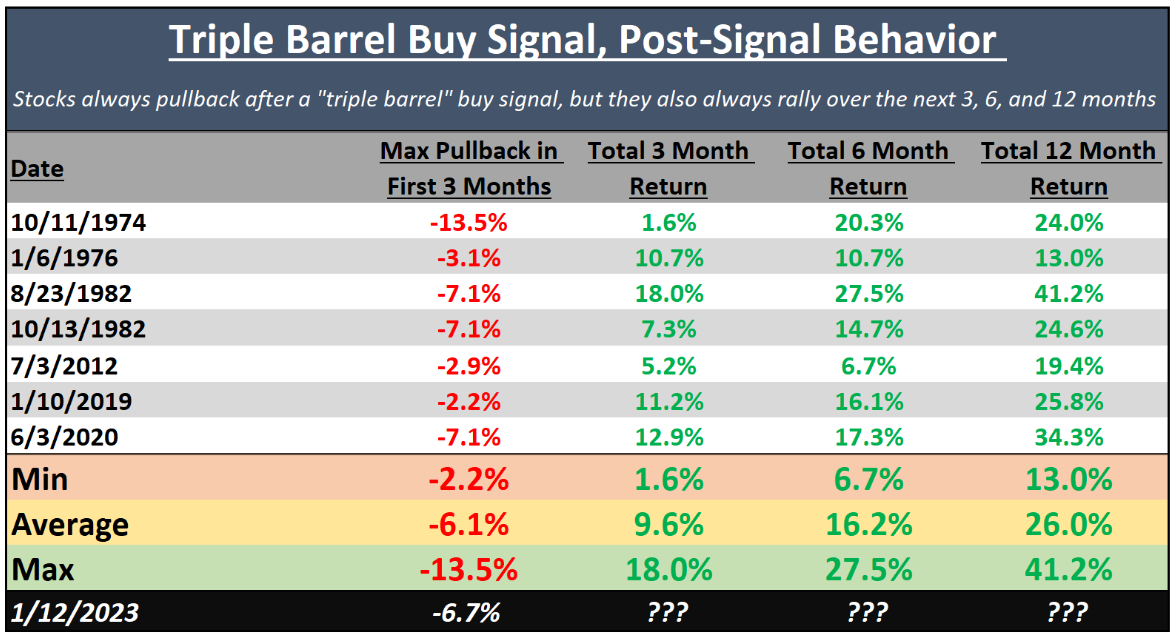

In the past, we’ve only had “Double Barrel” buy signals – instances where two signals were triggered on the same day. That has happened just seven times since World War II.

In all seven instances, the stock market was higher three, six, nine, and 12 months later.

But there’s a catch: The stock market always fell first before it soared into a new bull market.

That’s because, in order to trigger multiple ultra-powerful breadth thrust signals, you need a lot of buying power. When you have a lot of buying power, you tend to push stocks into near-term overbought territory. And when stocks jump into near-term overbought territory, they tend to pull back a little.

In each of the seven times since WWII that the stock market triggered a “Double Barrel” buy signal, stocks suffered a pullback of at least 2% over the subsequent two months. On average, those pullbacks were about 6%.

Every time, stocks bottomed after the short-term pullback, then rallied over the next month… the next 4 months… and the next 10 months.

In other words, history says you don’t want to buy stocks immediately after a Double or Triple Barrel buy signal is triggered. It’s best to buy two months after the signal is triggered – once stocks have had time to cool down and right before a big face-melting rally starts.

And that’s exactly where we are today.

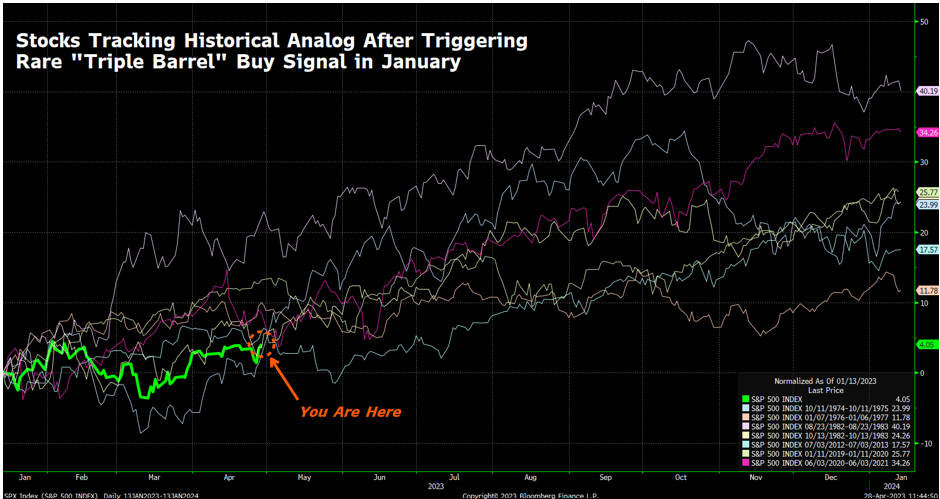

Following the Historical Pattern The stock market initially rallied after the Triple Barrel buy signal was triggered in mid-January. Then, it suffered a ~6% pullback in February. It bottomed in early March and is now rebounding from that selloff.

This is buying time.

This is typically when stocks bottom after a Double or Triple Barrel buy signal – about two months later and following a ~6% pullback. History says that from here, stocks will rally anywhere from ~10% to ~40% into January 2024.

I have a feeling this rally is actually about to go parabolic very, very soon.

The closest analog to the current post-signal trajectory is 1974/75. That is, in the three months since triggering a Triple Barrel buy signal in January 2023, the way stocks have acted is very similar to how they acted in the three months after triggering the same buy signal in October 1974.

Right around this point in the 1974/75 parallel, the S&P 500 went vertical. The market soared about 20% higher in two months and 40% higher in six months.

I think the market could be due for a similar surge over the next few months. | | | | SPONSORED We've found evidence of an ultra-rare market phenomenon forming. It's called a Convergence Shockwave, and it means you have a brief window to capture decades’ worth of S&P gains in just a fraction of the time. To discover how you could bank 1,000% gains with the momentum behind this shockwave, click here for details. Learn more here. | | | The Final Word After a wave of strong earnings reports hit the tape this past week, investors are feeling great. We should get a dovish Fed meeting this coming week, then a soft inflation report in two weeks.

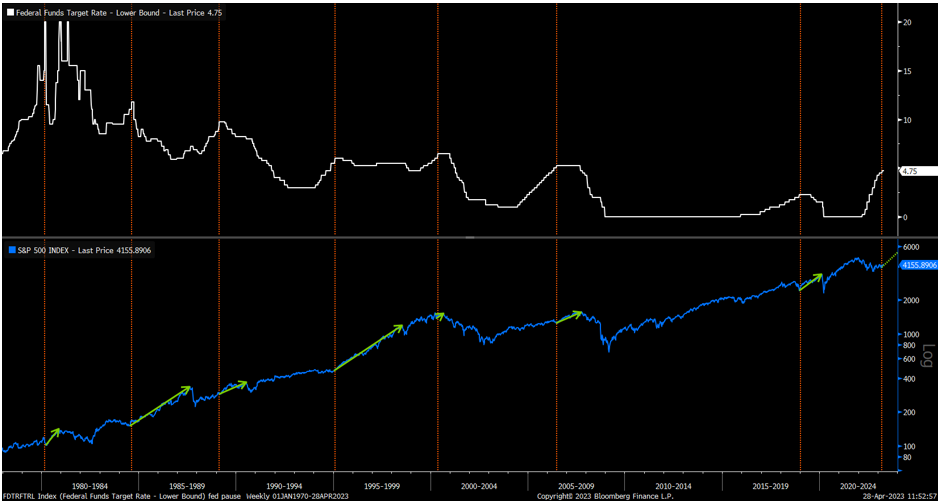

And in June, we expect that we’ll finally get the long-overdue and highly-anticipated Fed pause – which, as the chart below shows, tends to spark big market rallies.

The fundamentals agree with the technicals here. Stocks are about to go vertical.

Of course, if the stock market does go vertical over the next few months, certain individual stocks are going to soar 100%, even 200%-plus in a hurry.

For example, the S&P 500 is up only 9% so far in 2023. Yet, already this year, 130 different stocks have doubled. About 30 stocks have already tripled. And a dozen have already quadrupled.

All in just two months, in a market that’s up just 9%.

Imagine how many stocks will double, triple, quadruple, and rise 5X over the next 10 months if the market rallies 20%-plus in that time.

But the question is, do you own any of them?

If you’re interested in buying stocks that could soar 100%, 200%, or 300%-plus over the next 10 months alone, we have just the stocks for you. Take Control of Your Financial Future

Sincerely,

|  | | Luke Lango

Editor, Hypergrowth Investing On the date of publication, Luke Lango did not have (either directly or indirectly) any positions in the securities mentioned in this article. | | | | |

Comments

Post a Comment