The Important News From the PCE… And The Retailer That Is Benefitting Dear Savio, Over the last two weeks, we’ve received a lot of inflation data.

From the Consumer Price Index (CPI) and Producers Price Index (PPI) numbers for August announced just two weeks ago to this Friday’s Personal Consumption Expenditures (PCE) Price Index, Wall Street has had quite a bit of inflation data to digest!

Now, we covered the CPI and PPI readings for August last week, but let’s quickly recap the numbers… - The latest CPI showed headline inflation increased 0.6% in August and is up 3.7% year-over-year

- Core CPI, which excludes energy and food, rose 0.3% in August and is up 4.3% year-over-year

- Headline PPI rose 0.7% in August and is up 1.6% year-over-year

Yesterday, the PCE reading for August was released. This index is the Federal Reserve’s favorite inflation indicator, as it provides a more comprehensive range of goods and services.

So, in today’s Market 360, let’s review the big numbers from yesterday’s PCE report. Then, we’ll take a closer look at a company that is benefiting from inflation right now – and whether that makes this stock a good buy. The Personal Consumption Expenditures Report The Commerce Department reported that PCE only rose 0.1% in August (down from 0.6% in July) marking its lowest rise since September 2021. The annual pace now sits at 3.9% (down from 4.2% in July). Economists had forecasted PCE to increase 0.2% in August and 3.5% year-over-year.

Consumer spending was only 0.4% in August, well below the 0.9% recorded in July. Core PCE, which excludes food and energy, increased 3.9% year-over-year (down from 4.3% in July), which was in line with expectations. For August, core PCE rose 0.1%. Energy prices jumped 6.1% in August – up significantly from the 0.1% increase in July. Food prices rose 0.2%, which was down from the 3.5% increase in July.

Overall, the PCE was a reassuring sign that inflation is cooling off. It also gives the Fed more reason not to raise key interest rates at its next Federal Open Market Committee (FOMC) meeting. I should add that it's not only the U.S. who’s seeing a decline in inflation; it's also Europe and Germany. Eurostat, which covers the entire European Union (EU), reported that consumer price inflation of 4.3% was down sharply from the previous month. So, we're getting there, folks. Everything's calming down. The Retailer Benefitting From High Inflation While the high gas and food prices remain problematic, some companies are benefitting from them. In fact, the inflation spike recently was actually a boon for one particular company’s top and bottom lines.

I’m talking about Costco Wholesale Corp. (COST).

Costco released fiscal fourth-quarter earnings results on Tuesday that topped analysts’ earnings and revenue estimates. With their offering to buy bulk food and get gas at their pumps for cheaper costs, they have been reaping the benefits of shoppers turning to membership clubs.

For its fourth quarter, Costco announced earnings per share of $4.86, which beat expectations for earnings of $4.78 per share by 1.7%. This compares to earnings of $4.20 per share in the same quarter a year ago. Revenue jumped 9.4% year-over-year to $78.94 billion, which topped revenue expectations for $77.9 billion by 1.3%.

For the full 53-week fiscal year, revenue came in at $237.71 billion, compared to $222.73 billion in the 52-weeks fiscal year of 2022. Likewise, earnings per share was reported to be $14.86, which was higher than last year’s $13.14 earnings per share.

A big driving factor behind these numbers is higher gas prices. During the earnings call, Costco CFO Richard Galanti stated: Gas has been stronger for us, and we believe [for] all retailers in the last few years. At the end of the day, we feel good about our competitive position on gas prices. It’s increased and we’re still quite profitable. Down a little bit from a year ago, but nonetheless quite profitable. Costco has also benefitted from the rising food costs. Galanti stated: Overall, for the fiscal fourth quarter, food and sundries were relatively strong once again… In terms of Q4 comp sales metrics, traffic and shopping frequency increased 5.2% worldwide and 5% in the United States. Also interesting to note, Costco has recently started selling 1 ounce gold PAMP Suisse Lady Fortuna Veriscan bars. On the earnings call, Galanti stated that the bars are “typically gone within a few hours, and we limit two per member.”

Source: Costco.com Gold has long been viewed as a good hedge against inflation. With inflation still high, it’s not surprising that Costco’s gold bars are selling like hotcakes. Picking the Winners So, does Costco’s earnings make the stock a buy right now?

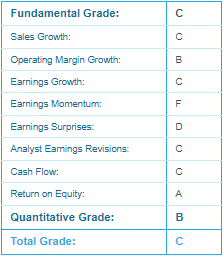

According to my Portfolio Grader, the answer is “no.” As you can see in the Report Card below, COST currently holds a C-rating, making it a “Hold.”

So what should you focus on if you want to invest in the winners? Well, it’s quite simple…

Stocks with stronger earnings momentum, sales growth and positive analyst revisions. In other words, the fundamentally superior stocks tend to be the winners.

If you’re not sure where to start, then consider my Growth Investor service. My Growth Investor Buy Lists are chock-full of these fundamentally superior stocks anticipated to grow their sales and earnings, including companies that are poised to prosper in this inflationary environment.

So, if you’re looking for the best inflationary plays then join me at Growth Investor today. I am confident that my Growth Investor stocks will emerge as the market leaders and deliver strong profits to investors.

In fact, I just added two market leaders to my Buy Lists in my Growth Investor Monthly Issue for October yesterday evening, as well as my latest Top Stocks lists.

To access my latest Growth Investor Monthly Issue – including my newest recommendations – click here and become a member of Growth Investor now.

(Already a Growth Investor subscriber? Go here to log into the members-only website.)

Sincerely, |

| Louis Navellier

Editor, Market 360

P.S. Once upon a time, investing was fairly simple… you would buy a stock in a growing that made real products and play the waiting game.

But I found an unconventional strategy will kill “buy and hold” investing… and unlock tens of thousands of dollars in extra income for people who understand this secret.

Your broker will doubt it. Financial pundits will deny it. But, as I will show you here, anyone with an internet connection and a few minutes to spare can start collecting extra income now.

Click here to learn more now.

The Editor hereby discloses that as of the date of this email, the Editor, directly or indirectly, owns the following securities that are the subject of the commentary, analysis, opinions, advice, or recommendations in, or which are otherwise mentioned in, the essay set forth below:

Costco Wholesale Corp. (COST) |

Comments

Post a Comment