| |  | | March 30, 2024 | Double-digit gains in less than a month? Yes, it’s true If it sounds too good to be true, it probably is.

I was raised on that maxim. It’s a pretty good way to approach a world where so many people seem all-too eager to cheat you.

Looking at the gains boasted by Wall Street legends, it often does sound too good to be true….

Names such as Warren Buffett, George Soros, Benjamin Graham and Bill Ackman … All of them became unbelievably wealthy by investing.

But we should all remember that the names everyone knows don’t do it alone. Certainly, no one on Wall Street does it alone.

According to The Street, Wall Street firms employ 180,000 people. They don’t all have the job of picking stocks, but they all belong to an ecosystem – analysts, auditors, computer programmers, and sector specialists – that is designed to beat the competition, and you… to the next big winner.  How is a regular investor, without access to the fastest computers and teams of analysts, supposed to achieve outsized gains? Is there a way to find the stocks that are headed up without being an expert, or employing a team of experts? ADVERTISEMENT  Having just shed a trillion dollars…

S&P Global says, the money supply is “falling at an unprecedented rate.”

MarketWatch calls it the “incredible shrinking money supply.”

Could the Fed be running an operation that shrinks the dollar pool to zero?

One top analyst says “YES!”

Click here for the full story Let’s just go ahead and admit that everyone has a “system” when it comes to the stock market You may not think of it that way, but that’s what it is.

Maybe you like to own only blue-chip stocks.

Maybe your system focuses on finding established stocks that stand the test of time thanks to beloved brands and loyal customers.

Maybe you are a value investor.

Your system involves finding companies with stock prices that appear undervalued relative to the intrinsic value of the company’s assets and cash flows.

Or, maybe your system is more sector-based. You like cutting-edge technology stocks, or energy stocks, or luxury retail stocks.

All these systems can produce the odd outsized winner. But at the end of the day, only one thing really matters when it comes to stocks and growing your wealth…

A price breakout.

After all the analysis and discussion, the only thing that will make a difference to your portfolio is whether the stocks you own rise in value while you own them.

If you’re a blue-chip investor, you might own the bluest of the blue. But if its price falls while you own it, you’ll lose money.

If you’re a value investor, you might own the most undervalued stock of all time. But if the market doesn’t see it the same way and the price drops after you buy, your system has made you poorer.

What the individual investor needs is a way to isolate which stocks are poised to go up. Not the stocks that have already doubled … but the ones that sit on the cusp of the price breakout we all want. ADVERTISEMENT  Crypto pioneer Charlie Shrem says a massive Melt-Up in crypto has begun. It could drive Bitcoin to $1 million. History shows that smaller altcoins could soar as high as 134X, 646X, or more.

Click here to find out which five coins Charlie thinks you should buy right now Breakout stocks in the hottest sector Luke Lango’s High Velocity Stocks service focuses on the one sector that sees 30% of the market’s biggest winners – biotechnology.

Now, you might think that investing in biotechs is akin to putting money into a black box. Assessing the odds of a drug or medical device making it to market and becoming successful is extremely difficult. These companies are complex and investing in them can be risky.

Until now.

I’ll let Luke explain… We have finally crafted a quantitative strategy to smartly invest in biotech stocks.

This strategy – built from our core AI Trader system, which leverages quantitative stage analysis to identify stocks in “breakout mode” – focuses exclusively on price action dynamics and completely ignores the complex science behind these firms. It makes biotech investing easy.

It also makes it much less risky. By relying on proprietary price signals, our system can help us single out the potential big-time biotech winners and avoid the horrendous losers.

In other words, we’ve created a trading system that maximizes the upside of biotech investing while minimizing the downside.

It’s a best-of-both-worlds situation. How does it work?

In short, at any given point in time, every stock is either going up, down, or sideways.

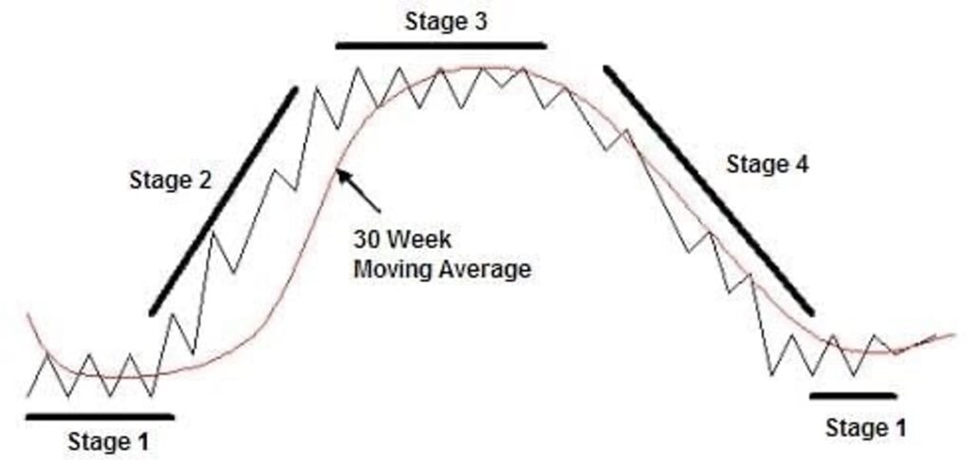

To that end, every stock is always in one of four unique stages: 1) going sideways at a bottom, 2) going up, 3) going sideways at a top, or 4) going down.

Stage analysis is the science behind figuring out which of these four stages a stock is in at any given point in time.  The key to achieving big returns consistently in a short amount of time is to find stocks on the cusp of entering Stage 2 – or stocks that are already breaking out in Stage 2.

And avoiding big losses consistently means avoiding stocks that are on the cusp of entering Stage 4, already in Stage 4, or are going nowhere in Stages 1 or 3.

This system can work for stocks in any sector, so why focus on biotech? ADVERTISEMENT  In extensive back testing, it also identified massive breakouts from Amazon, Tesla, Uber, and Meta.

Now it’s zeroing in on what it calls the “3 Kings of A.I.’s Massive 2nd Wave.”

I’d hate for you to miss out again.

Details Here As I noted above, biotech stocks account for about one-third of the top market performers on any given day, month, and year. It’s not the biggest sector … but it produces the most big winners.

According to Grand View Research, the global biotechnology market was valued at $1.55 trillion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 13.96% from 2024 to 2030.

That’s quite the reliable tailwind for the entire sector.

Using Luke’s quantitative strategy, you can ride the hottest stocks getting the benefit of that tailwind.

Just in 2024, Luke has taken partial profits such as 56% in 20 days, 77% in 22 days, and 94% in 24 days.

He takes partial profits often to lock in gains and then rides the remainder of the position for as long as it continues to go up.

Earlier this week, Luke hosted a free special event to explain how AI and the election are accelerating gains in this sector like never before.

You can watch a replay of Luke’s Second Trillion-Dollar AI Trade even by clicking on the link.

Enjoy your weekend,  | | Luis Hernandez

Editor in Chief, InvestorPlace | | | | | | | | | | | |

Popular posts from this blog

As your guide, I will explain effective canvas fabric treatments . Achieving reliable waterproofing depends on choosing the correct agent—like wax, silicone, or acrylics—matched to your specific canvas material and its function. This protection is fundamental for extending the life of canvas items exposed to weather, including applications like outdoor gear , protective covers (like boat covers ), apparel, and awnings . The process requires meticulous application onto clean, dry fabric. Sufficient time for the treatment to cure fully is necessary for bonding. Maintaining the treated canvas involves regular cleaning and periodic reapplication. I will detail the required steps: selecting the appropriate canvas type , identifying the best waterproofing methods, executing the application steps correctly, and understanding long-term fabric care . Key Takeaways: Identify your canvas type (cotton, synthetic, blend) to choose the best-suited treatment . Select a t...

PLUS: 6 Vanguard ETFs to Build a Better Portfolio InvestorPlace Insights 7 Troubled Dividend Stocks With Yields Too Good to Be True By Louis Navellier Usually there's a trade-off between great rewards and great risks. These dividend stocks are perfect examples of that. READ MORE 6 Vanguard ETFs to Build a Better Portfolio By Neil George If you want to build a solid portfolio within the Vanguard ecosystem, these are six great funds to start with. READ MORE America's #1 Penny Pot Stock to Explode by December 31? Right now, this pot stock trades for under 50 cents per share. But industry insiders are now predicting it could easily rival the rise of Tilray, Aurora and Canopy Gro...

When it comes to AI, most have one question: How in the world do you invest in it?͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏...

| |

Comments

Post a Comment