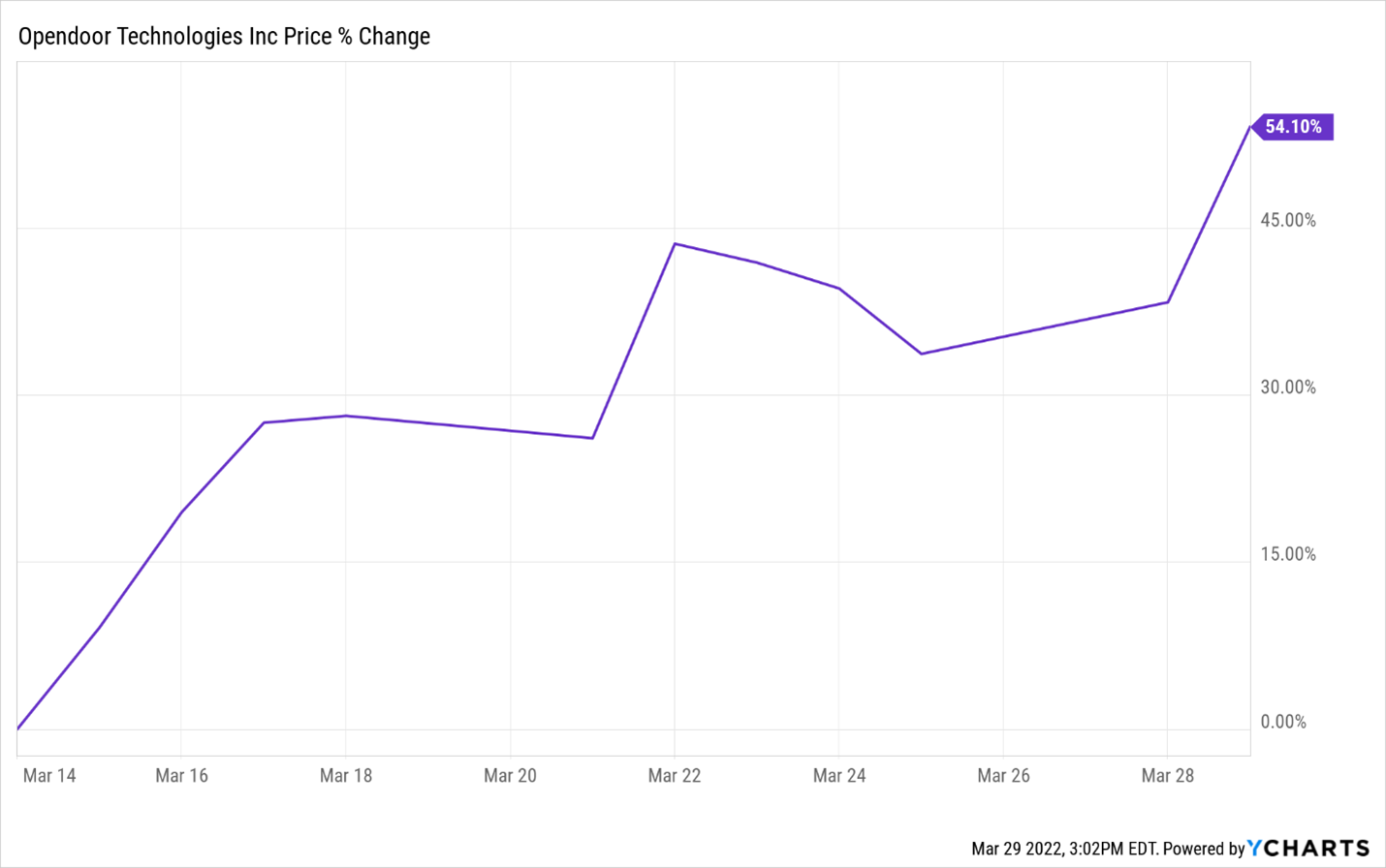

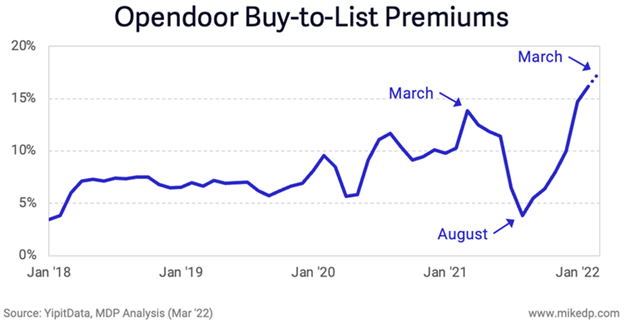

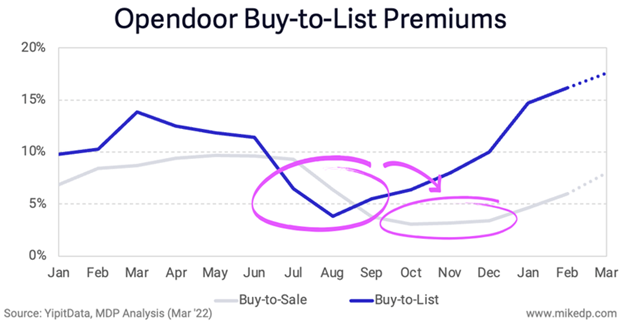

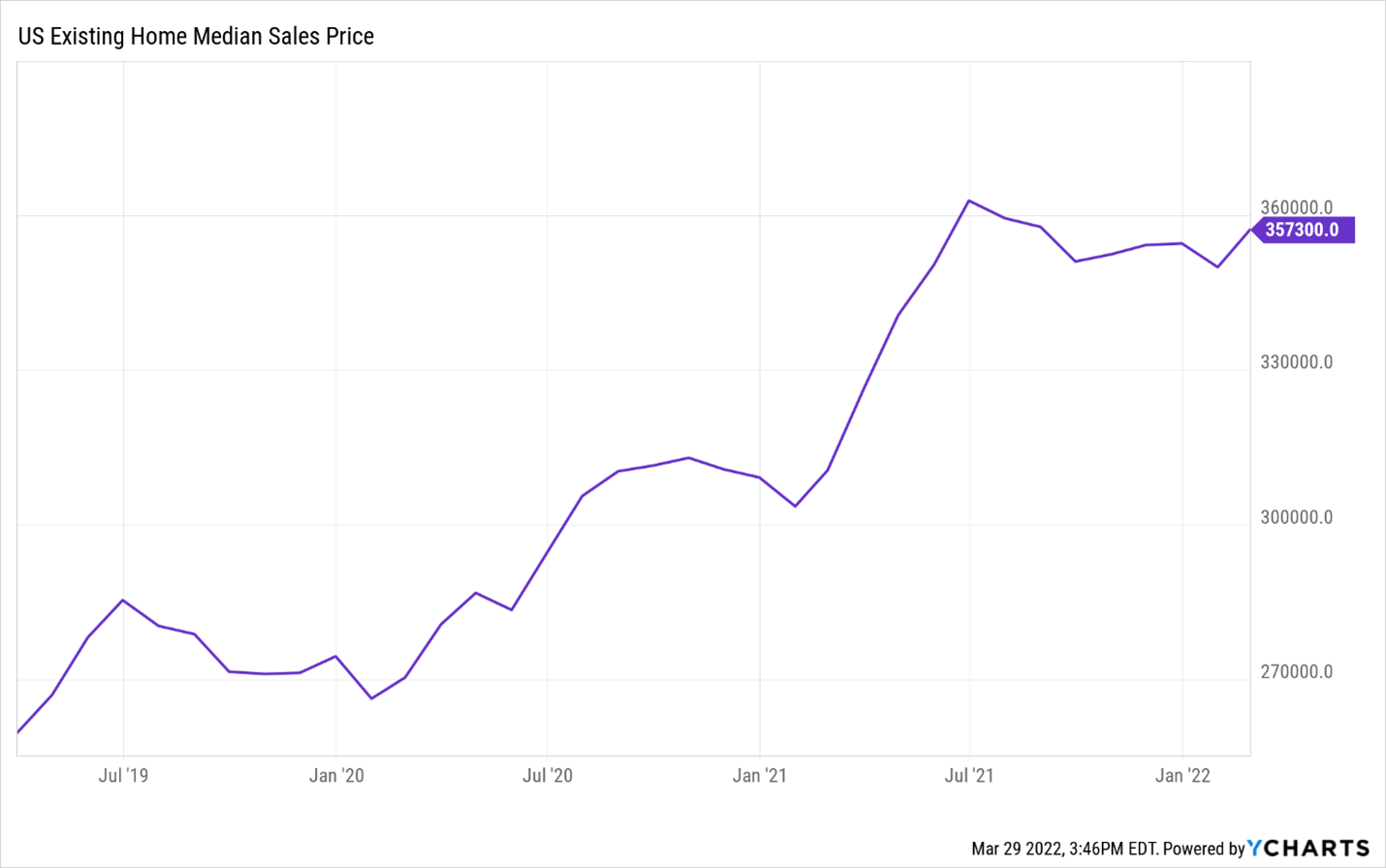

| Special Research Report Unique Research Shows That Opendoor Stock Is Set for a Huge Quarter One of our "Millionaire Maker" stocks -- those we think will make you a millionaire in the long run if you buy and hold them -- is iBuying giant Opendoor (OPEN) stock. Sure, it's had a rough time these past 12 months. But our conviction on Opendoor has not wavered one ounce. In fact, we've only grown more bullish on the stock as its price has fallen against the backdrop of ever-improving fundamentals and rising revenues. And it appears Wall Street may be finally starting to see things our way. Over the past two weeks alone, Opendoor stock has rallied more than 50%.  But we aren't writing this research report to applaud a rebound rally. Rather, we're writing this report to communicate why we believe this big rally in Opendoor stock is far from over -- and why the stock will power above $100 in the long run. We've uncovered some unique and important research that underscores that Opendoor's business is absolutely on fire right now and that the company is going to make heaps of money in the first half of 2022. To that end, we believe Opendoor's next quarterly numbers will be fantastic -- and in the lead-up into (and after) that earnings report, OPEN stock could soar. We think this stock will hit $20 by the summer and $100-plus within five years. These are not figures pulled from thin air -- we've done the research and, well, we'll let the data speak for itself... The Most Important Metric for Opendoor Arguably the most important metric for Opendoor -- and any iBuyer, for that matter -- is the buy-to-sale premium. That is, Opendoor is in the business of buying and selling homes. If the company wants to make money in that business, it needs to buy homes at a certain price and then subsequently sell those homes at a higher price. The bigger the delta between buy and sell price, the more money Opendoor makes per home -- and the more profitable the overall business becomes. Simple, right? That delta between buy and sell price is called the buy-to-sale premium. If Opendoor buys a home at $100,000 and then sells it for $110,000, its buy-to-sale premium on that home is 10%. To that extent, that premium is the single biggest driver of profitability of the Opendoor business model. The bigger the premium, the more money Opendoor is making per home sold and the higher its profit margins. The key to Opendoor becoming enormously profitable, then, is to couple increasing scale with rising buy-to-sale premiums. Well, we already know that Opendoor is scaling very quickly and growing revenues at a triple-digit pace. And now it appears that its buy-to-sale premiums are finally rising to record highs, too. Opendoor's Buy-to-Sale Premiums Are Soaring According to unique and compelling research from Mike DelPrete -- the world's foremost real estate technology expert -- Opendoor's buy-to-list premiums are surging right now. Critical distinction: Buy-to-list premiums are those at which Opendoor lists a home for sale relative to its purchase price. Buy-to-sale premiums are those at which Opendoor sells that home. DelPrete's research shows that Opendoor's national buy-to-list premium has soared in early 2022 to record highs of 17%. That is, across the U.S., Opendoor's houses are currently listed at a median price of 17% higher than what they were purchased for about 70 days earlier.  This is the highest reading ever for Opendoor, exceeding the previous buy-to-list premiums record set last March, and is well-above where the premiums stood just six months ago (around 5%). This is important because buy-to-list premiums are a historically proven leading indicator of buy-to-sale premiums. That is, when buy-to-list premiums plunge, buy-to-sales tend to plunge over the subsequent quarter, too, on the idea that what gets listed is eventually sold at or near its listing price. Similarly, when buy-to-list premiums surge, buy-to-sales premiums tend to follow in lockstep. The implication of the early 2022 surge in buy-to-list premiums for Opendoor, then, is that buy-to-sales -- which have already risen sharply in February and March -- will continue to rise sharply in the second quarter (April, May, and June).  As one would expect, Opendoor's gross margins correlate tightly with the company's buy-to-sale premiums. Rising buy-to-sale premiums in the second quarter of 2021 led to a jump in gross margins to 13.5%. Falling buy-to-sale premiums in the third and fourth quarters of 2021 correlated with a drop in gross margins to 10.3% and 7.3%, respectively. On average, it appears that Opendoor's buy-to-sale premiums in a quarter are about three percentage points below gross margins. Therefore, it seems Opendoor is set to report record gross margins of 15% or higher in the second quarter of 2022. Long story short, Opendoor is going to make a lot of money in the first half of 2022. And all that money should help propel Opendoor stock meaningfully higher by the summer. We see this stock making a run back above $20 by then. Why This Matters Long-Term Some pundits may be arguing that Opendoor's buy-to-list premiums are rising simply because of the current housing market. That is, home prices are soaring right now, so it's no wonder Opendoor's buy-to-list premiums are soaring, too. But that is a vast mischaracterization of the current situation. Home price growth has moderated since summer 2021. The median sales price of an existing home in the U.S. topped out in July 2021 at $362,900. Since then, median home sales prices have oscillated between $350,000 and $360,000. Today they sit about 2% below where they were in July 2021 and are basically flat with where they were 60 days ago.  Remember: Opendoor's average holding period is about 60 days. Therefore, if Opendoor were just "following the market," its buy-to-list today would be right around 0% since median home sales prices haven't changed over the past 60 days. Instead, Opendoor's buy-to-list premium is soaring to 17%, a very impressive 17-percentage-point outperformance of the market. Clearly, the company isn't just riding a hot housing market -- it's doing something right to out-execute the market. That "something" is rooted in Opendoor's pricing algorithms. If you've followed our analyses of Opendoor over the past year or so, you know that a big piece of our bull thesis is that this isn't just another iBuyer. Opendoor is a tech-driven iBuyer with an army of expert data scientists, coupled with an ever-expanding treasure chest of proprietary housing market data. With these resources, Opendoor managed to build world-class pricing algorithms that are better at predicting home prices than anything else in the world. It's a bold claim. But we believe Opendoor's current buy-to-list premiums strongly corroborate it. How else is Opendoor rattling off a 17% buy-to-list in a flat price market? How is Opendoor driving those 17 points of pricing outperformance? The only reliable answer is its elite pricing algorithms. Opendoor bought homes in late 2021 that its algorithms showed were dramatically underpriced. It fixed those homes up and is now selling them at huge premiums. That's the power of Opendoor's core pricing algorithm. It is a scalable "ninja skill" that is highly defensible and exceptionally durable -- and one that will allow the company to not just dominate the iBuying space but enable it to succeed in hot, cool, and flat housing markets. To that end, we believe Opendoor's soaring Buy-to-List Premiums in 2022 aren't just a near-term bullish indicator but a long-term one, too. They give us faith that this company has the core technology to reshape the housing industry in a way that no other iBuyer can. The Final Word The big question mark surrounding Opendoor stock isn't whether consumers are willing to buy and sell their homes online -- they are unequivocally willing to do that. That's why Opendoor has grown revenues by more than 450% year-over-year in every quarter since the housing market bounced back from the Covid-19 pandemic in early 2021. Rather, the big question mark surrounding Opendoor is whether the company can sustainably make profits. But that question now has an unequivocal answer, too -- and it's a resounding YES. Thanks to Opendoor's exceptional pricing algorithms, it's currently listing homes for 17% above what it bought them for about 70 days ago, despite median home sales prices across the U.S. being basically flat over that same stretch. This proves that even in a flat price market, Opendoor can achieve gross profit margins consistently north of 15% -- far more than enough to produce 5% to 10% net profit margins at scale. In other words, we now know that Opendoor can be consistently profitable. Coupled with the fact that we always knew the company is going to grow like wildfire over the next several years, it's become clear that Opendoor is a huge long-term winner. If someone were to put a gun to our head and force us to buy and hold one stock for the next five years, we'd pick Opendoor stock without hesitation. By then, we think this will be a $100-plus stock. Sincerely, |

Comments

Post a Comment