The Fed holds rate steady but doesn’t throw cold water on a September cut … Wall Street got the dovish Powell it wanted … Uncle Sam needs cuts more than anyone Today, as was widely expected, the Federal Reserve held rates steady at the current target rate range of 5.25% - 5.50%. What was uncertain was how Federal Reserve Chairman Jerome Powell would sound regarding a September cut. Here’s a hint…  If that’s not clear enough, here’s Powell from his press conference: If [the test of continued cool data] is met, a reduction in the policy rate could be on the table as soon as the next meeting in September. Today, Wall Street got what it wanted – a dovish Powell who, frankly, didn’t present any major obstacle to a rate cut at the Fed’s September meeting. It’s clear that Powell and the Fed have shifted their focus from inflation toward the labor market Listening to the Fed Chair speak, it’s apparent that the greater risk appears to be labor market weakness than a resurgence in inflation. The official Fed policy statement even dropped language saying it is “highly attentive to inflation risks.” That said, a confident sounding Powell painted the picture of a labor market that is normalizing rather deteriorating. Wall Street bulls couldn’t have asked for much more. Here are various excerpts from Powell’s post-announcement press conference: - “The second-quarter inflation readings have added to our confidence and more good data would further strengthen that confidence.”

- “The broad sense of the committee is that the economy is moving closer to the point at which it would be appropriate to reduce our policy rate.”

- “We are watching labor market conditions quite closely. I would not like to see a material further cooling in the labor market.”

- Powell noted that the economy looks “completely different” than a year ago, and “What we’re thinking about all the time is: How do we keep this going?”

- When asked about the political optics of a rate cut in September, Powell replied “We never use our tools to support or oppose a political party, a politician or any political outcome.” He also stressed that current policy does not reflect the Fed’s guess as to who might take the White House and what policy that could mean.

As for Wall Street’s response, it was already in a good mood leading into Powell’s press conference. That was based on chip giant AMD’s strong earnings that reinforced the AI megatrend as a dominant market influence. But Powell did nothing to dampen the mood. The Nasdaq ended the day up 2.6%, with the S&P and Dow racking up gains of 1.6% and 0.2% respectively. | ADVERTISEMENT  Legendary investor Tom Gentile has just issued this critical warning tomorrow, August 1st.

Billionaires like Warren Buffett and Bill Ackman have already started to prepare.

Something big is happening…

And if you don’t prepare now, you could end up losing a big chunk of your savings in the coming months…

And spend years just trying to catch up.

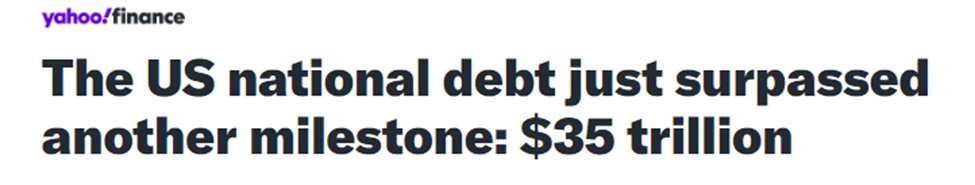

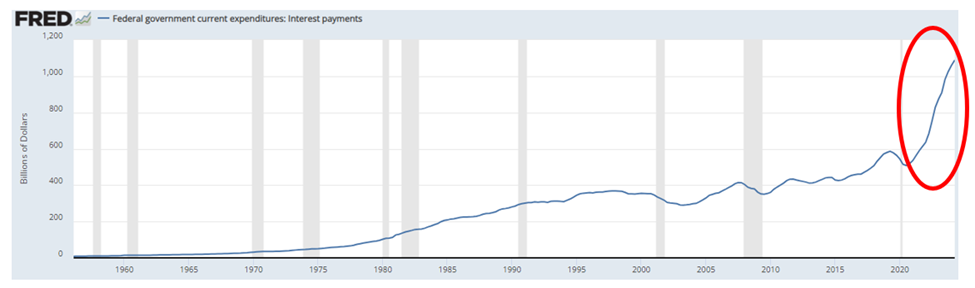

Click here now to get the details before it’s too late. | Now, while there are countless sighs of relief in the wake of today’s dovish news, there’s an especially loud one coming from one individual in particular… Uncle Sam. This Yahoo! Finance headline from yesterday explains why:  Our federal government has been getting jackhammered by today’s elevated interest rates. Thanks to the combination of its mindboggling spending over the last few years (or, alternatively, last few decades) and today’s elevated fed funds rate, the size of the interest payments on our national debt have gone vertical. See for yourself. The chart below dates to the 1950s. I’ve circled what’s happened in the wake of the pandemic.  To contextualize this, let’s go to The Kobeissi Letter from earlier this month: BREAKING: Annualized interest payments on US federal debt just reached an all-time high of $1.14 trillion.

This is more than DOUBLE the amount of interest recorded in 2022 when the Fed started raising rates.

To put this into perspective, even during the 2008 Financial Crisis, annual interest costs were ~$450 billion, or 60% lower.

As a % of GDP, net interest cost this year is on track to exceed the 1980s high of 3.2%.

By comparison, during World War II, net interest expense as a % of GDP was much lower, at 1.8%.

The US government needs lower interest rates more than anyone. For additional context, in 2017, net interest payments made up about 7% of federal spending. Here in 2024, they’ll come in about 13%. And for qualitative context, here in 2024, our government will spend more on its debt service than it will spend on our national defense budget. But let’s be honest – does this really matter? Our government has been fiscally irresponsible for decades, and yet here we. So, who cares that we just hit $35 trillion in debt and we’re spending more on debt service than defense? Will anything really change? Well, I won’t say anything will change tomorrow, but we’re getting closer to the point where, yes, things will change. To help explain why, let’s begin with Warren Buffett: My best speculation is that U.S. debt will be acceptable for a very long time because there's not much alternative…

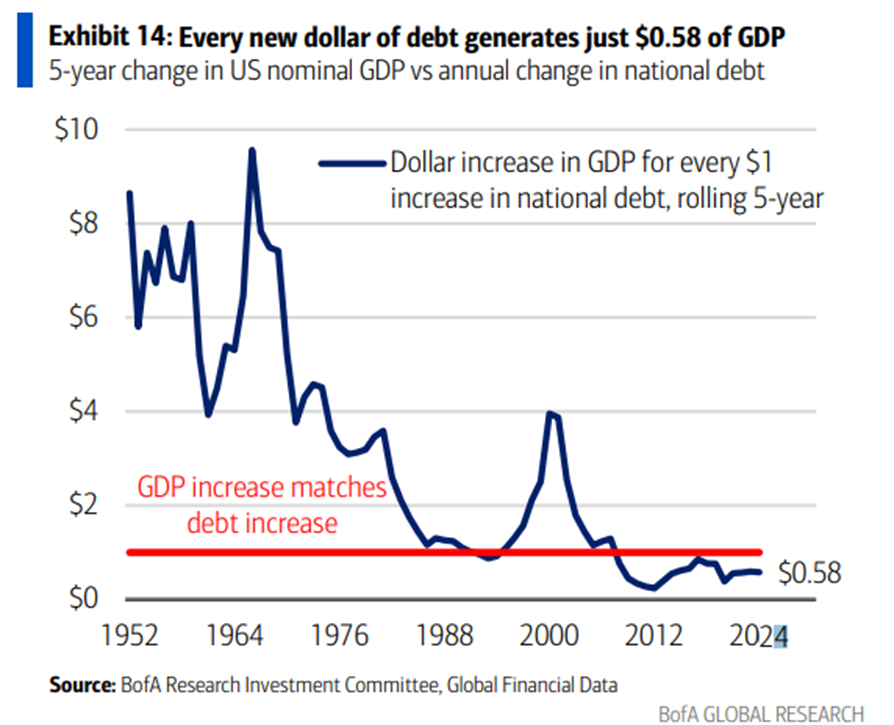

I don't worry about the quantity, I worry about the fiscal deficit… The fiscal deficit is what should be focused on. To be clear, the fiscal deficit is the differential between the government’s yearly revenues and yearly expenses. But why is this Buffett’s concern, exactly? What’s the real issue? To answer that, let’s turn to billionaire investor Stanley Druckenmiller of Duquesne Family Office. He sounded the alarm in an interview back in May: They’ve spent and spent and spent, and my new fear now is that spending and the resulting interest rates on the debt that’s been created are going to crowd out some of the innovation that otherwise would have taken place. There’s a name for what Druckenmiller is describing: the “crowding out effect” theory. It suggests that increased government deficit spending, leading to higher interest rates, ultimately requires more taxes. This tax burden demands a reallocation of capital within businesses (and family budgets) – away from research, productivity, and growth – toward the government’s black hole of spending. But let’s put a visual on this so you can see how bad it’s become. Below is a chart showing how much GDP productivity our economy generates from each dollar of national debt. We’re now exchanging $1 of debt for just $0.58 of productivity.  Source: Mike Zaccardi / BofA Research / GFD

| ADVERTISEMENT  According to expert investors Eric Fry, Luke Lango, Louis Navellier you could have little time to move your money before a major AI event rocks the stock market. Hundreds of stocks could collapse 50% or more in the coming weeks, but a handful could soar 10X as this story plays out.

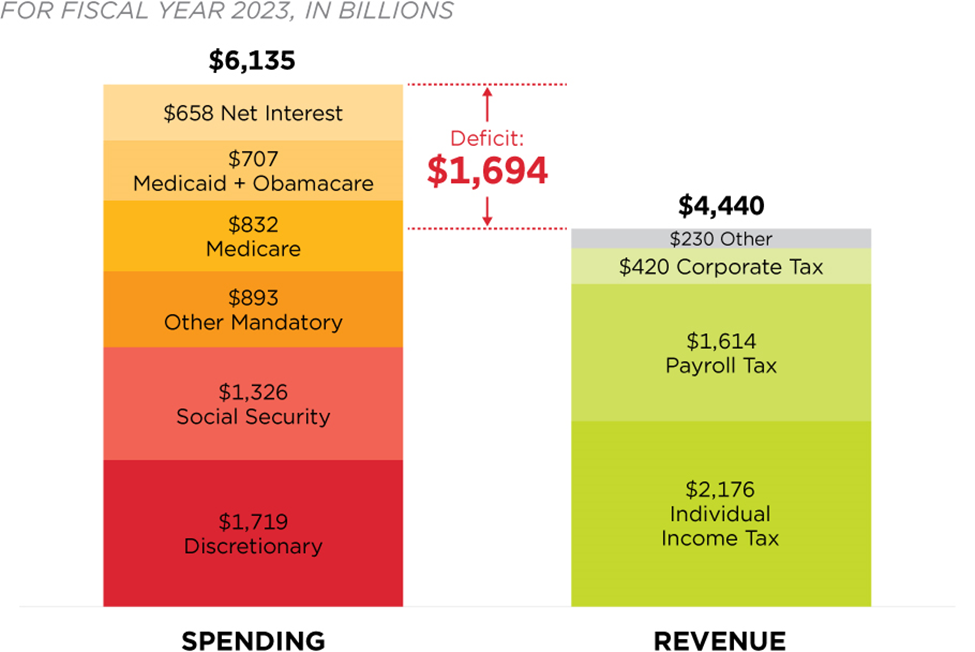

Learn more. | The cause-and-effect relationship between our government’s debt and your wallet So, we have a government that spends way more than it brings in. Here’s the visual from 2023 (it’s gotten worse since then):  Source: Federal Budget in Pictures

How might the government make up for this shortfall going forward? Well, it can do two things: increase taxes and/or issue more debt through the treasury market. And this points us toward November. As it appears today, a Trump presidency would result in lower taxes which would decrease our government’s revenues, exacerbating our debt/deficit challenges. Presumably, this would shift the government’s financial burden to the treasuries market – meaning higher bond yields. After the Trump/Biden debate, when odds of a Trump presidency soared, the bond market immediately recalculated. Here’s Fortune, from earlier this month: After last week’s debate hurt President Joe Biden’s chances of winning reelection, Wall Street strategists are urging clients to position for sticky inflation and higher long-term bond yields.

At Morgan Stanley, strategists including Matthew Hornbach and Guneet Dhingra in a weekend note argued that “now is the time” to wager on long-term interest rates rising relative to short-term ones. Meanwhile, a Harris presidency would likely mean higher taxes would be the primary generator of the government’s additional revenues. Here’s Morningstar: Before becoming vice president, Harris was a senator from California and a 2020 presidential candidate who said she would repeal Trump's Tax Cuts and Jobs Act...

At that time, Harris had tax proposals that skewed to the left of Biden's positions, tax-policy prognosticators noted this week.

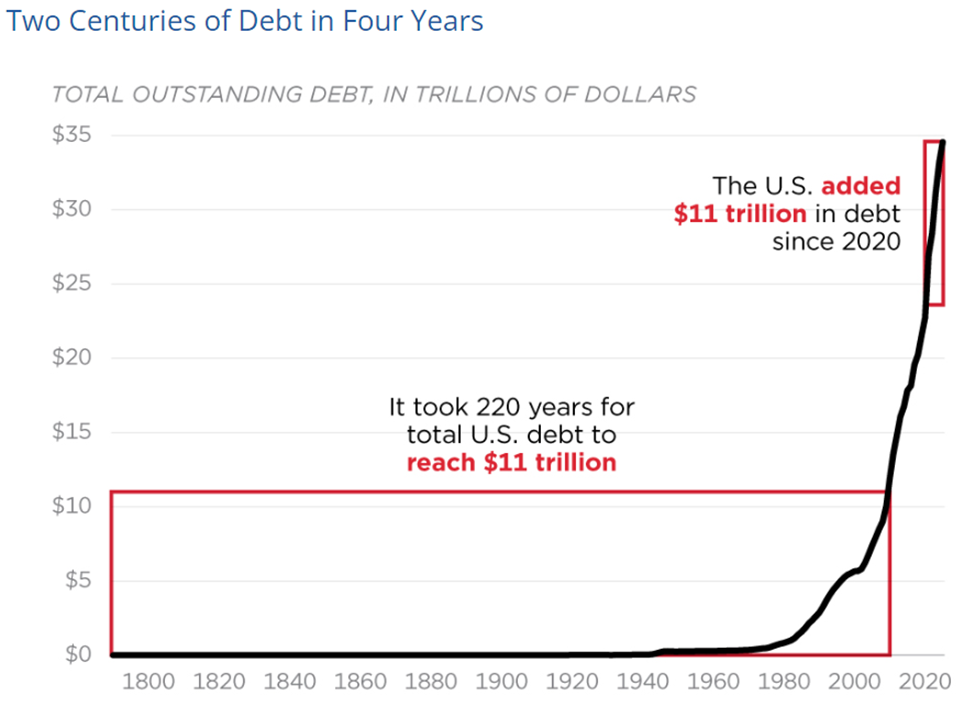

Her ideas included instituting a generous tax credit for low- and middle-income families and taxing stock, bond and derivative trades to fund healthcare coverage. As we pointed out in the Digest earlier this week, there’s a “pick your poison” tradeoff here. Do you want to go with the potential for higher inflation, accelerating debt, and higher bond yields with Trump? Or do you prefer higher taxes and bigger government with Harris, this time with Uncle Sam most likely sticking his hand directly into your portfolio? Either way, you can see how our government’s deteriorating debt/fiscal deficit situation is accelerating this spiraling situation, and how we’re getting to the point where it directly influences your wealth. Circling back to today’s news from the Fed… Clearly, the prospect of lower yields is welcomed by our government. But maintain perspective… The 10-year Treasury yield isn’t going to drift lower to 2% and hang out there for a decade as it did during the 2010s (absent an economic meltdown that prompts Fed intervention). Though yields should drop, there will be a higher baseline going forward. So, our nation’s debt/deficit situation will only worsen without policy change and/or cuts to beloved entitlement programs. With neither of those things likely to happen, the question becomes “how far can we kick the can down the road?” No one knows the answer, but I’ll let you mull it for yourself after leaving you with one final graphic. As you’ll see below, it took our government 220 years to amass a debt of $11 trillion. It then took us just four years to do it again. How long until this vertical spike can no longer hold up under its own weight?  Source: Federal Budget in Pictures

Have a good evening, Jeff Remsburg |

Comments

Post a Comment